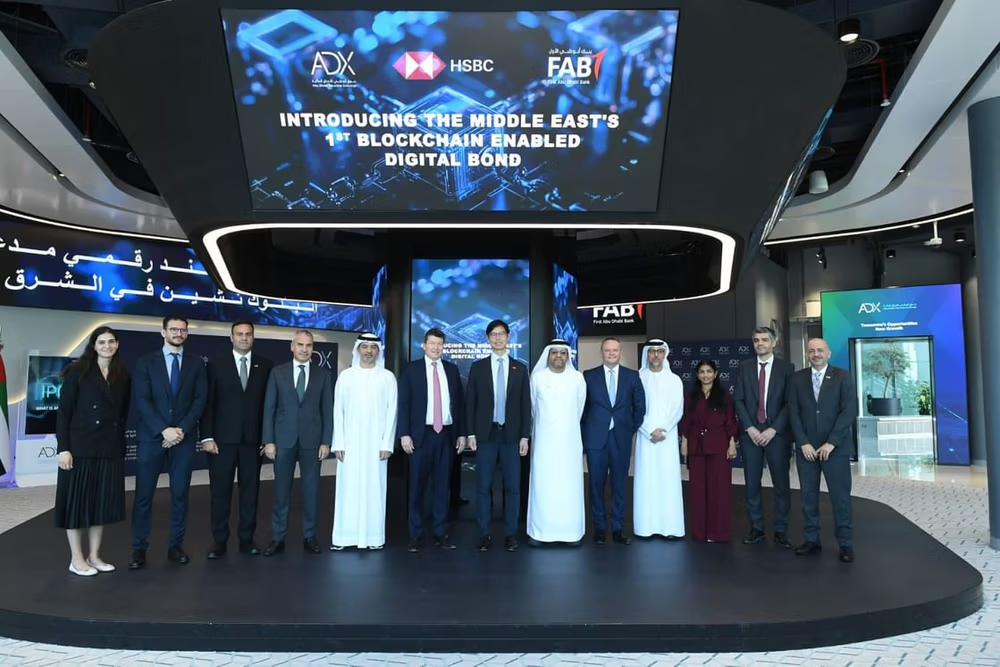

The Abu Dhabi Securities Exchange (ADX) has commenced the pricing stage for the first-ever distributed ledger technology (DLT)-based bond in the Middle East and North Africa (MENA) region. Issued by First Abu Dhabi Bank (FAB) and utilizing HSBC Orion, a digital assets platform, this issuance marks a significant stride in ADX’s financial innovation agenda and Abu Dhabi’s digital transformation efforts.

The upcoming listing is the result of a strategic collaboration among ADX, HSBC, and FAB, combining regional financial leadership with global expertise in digital issuance. The bond is leveraged by HSBC Orion, which is operated by the Central Moneymarkets Unit (CMU) in Hong Kong, and has been structured with support from leading international law firms to ensure high governance standards.

Global investors can access the digital bond through accounts held with CMU, Euroclear, and Clearstream. Access is also available by onboarding onto HSBC Orion as a direct participant or via existing custodians who can utilize one of the options above.

The introduction of this digital bond expands ADX’s product offerings and signifies the Exchange’s pioneering role in tokenized finance. Digital bonds, which are fixed-income securities recorded on blockchain technology, are designed to offer institutional investors enhanced operational efficiencies, improved settlement cycles, reduced counterparty risk, heightened security, and increased transparency.

HSBC served as the sole global coordinator, lead manager, and bookrunner for the transaction, playing a central role in bringing this end-to-end blockchain-based issuance to the MENA region.

Abdulla Salem Alnuaimi, Group Chief Executive Officer of ADX, commented, “The successful issuance of MENA’s first blockchain-based digital bond, in close collaboration with FAB and HSBC, marks a defining moment in our journey to transform capital markets through innovation. ADX was central in facilitating this milestone, ensuring the bond’s seamless integration with existing post-trade infrastructure and compatibility with global settlement standards.”

Lars Kramer, Group Chief Financial Officer at FAB, stated, “Together with ADX and HSBC, we are setting new benchmarks in efficiency, transparency, and security, while aligning with the UAE’s progressive regulatory framework.”

Mohamed Al Marzooqi, Chief Executive Officer, UAE, HSBC Bank Middle East Limited, added, “The successful launch of MENA’s first digital bond on ADX using HSBC Orion shows how we are transforming the promise of tokenisation into reality for our region.”

The bond has been designed to ensure compatibility with global settlement infrastructure, integrating digital technology with existing post-trade systems. This approach bridges traditional markets with next-generation issuance models, supporting broader institutional access to digital assets.

–Input WAM