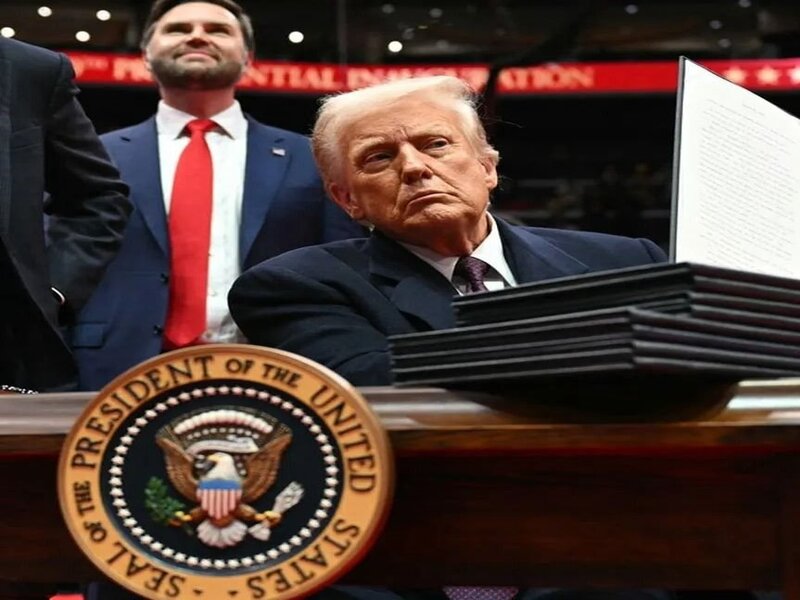

In a landmark policy shift, U.S. President Donald Trump has signed an executive order allowing 401(k) retirement plans to include alternative assets such as cryptocurrencies, private equity, and real estate. The move could open access to trillions of dollars in retirement savings for investment in markets previously off-limits to most Americans.

Under the order, the Department of Labor (DOL) will revisit existing fiduciary rules under the Employee Retirement Income Security Act (ERISA) that have traditionally limited 401(k) offerings to mainstream assets like stocks and bonds. The DOL, in coordination with the Securities and Exchange Commission and the U.S. Treasury, will now develop new regulatory guidelines to enable the inclusion of Bitcoin, Ethereum, and other alternative asset classes in employer-sponsored retirement plans.

Diversification or Risk?

Supporters say the move broadens investment choices and could enhance returns, particularly for younger, risk-tolerant savers looking for diversification beyond traditional markets. Critics, however, warn that introducing volatile and complex assets like crypto into retirement plans could expose savers to higher risks, liquidity challenges, and additional costs.

Financial analysts note that the success of the policy will depend heavily on how plan sponsors implement safeguards, risk disclosures, and investor education.

Immediate Market Reaction

The announcement sparked a rally in cryptocurrency markets:

- Bitcoin rose by around 2%, trading near $117,300.

- Ethereum jumped more than 5%, surpassing $3,800.

- Crypto-related equities and ETFs, including Coinbase and iShares Bitcoin Trust, also saw notable gains.

Market experts believe that the psychological impact of this policy—positioning crypto as a legitimate retirement asset—may fuel further institutional adoption.

What Happens Next

The new guidelines are expected to be drafted in the coming months, with plan providers such as Fidelity and Vanguard anticipated to play a key role in shaping product offerings. Full implementation could take 12–18 months, depending on regulatory reviews and industry readiness.

While the order marks a major milestone for the integration of digital assets into mainstream finance, industry leaders caution that diversification should not come at the expense of prudent risk management—especially for retirement savings.