JPMorgan Chase surpassed the expectations of analysts for the third quarter on Tuesday, as the trading and investment banking business brought in approximately $700 million in revenue than forecasted.

According to LSEG, the company reported that Earnings per share: $5.07 vs. expected $4.84 and Revenue, $47.12 billion vs. expected $45.4 billion.

In a release, the bank indicated that its profit increased by 12 percent to $14.39 billion or $5.07 per share compared to the previous year; therefore, the revenue soared by 9 percent to $47.12 billion.

Henceforth, the largest American banks have benefited from the services of the President Donald Trump administration.

They have accumulated more trading revenue because turbulence in their policies has shaken markets across the globe, compelling investors to take a new stance.

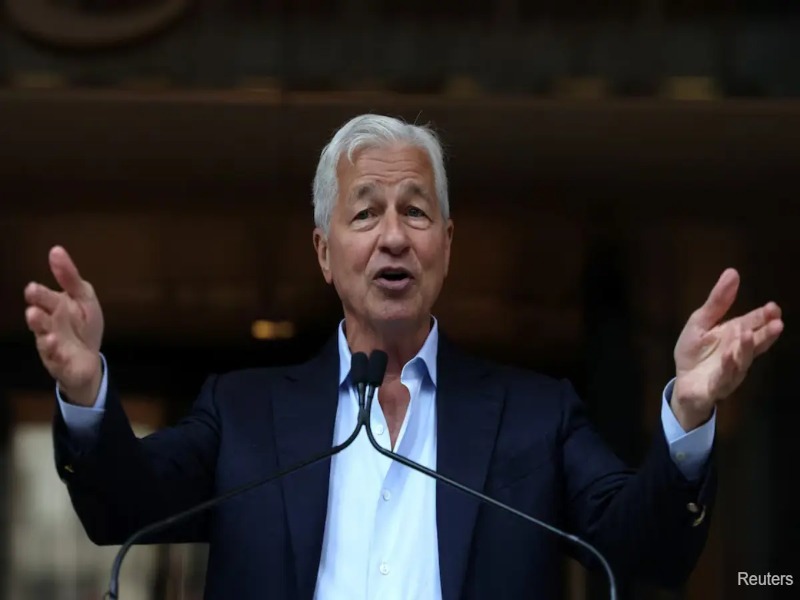

In a release, its CEO Jamie Dimon said that the trading bounty of $8.9 billion at JPMorgan was its largest third quarter.

Investment bankers are busier with a more relaxed attitude about mergers, and Trump bank regulators have suggested easing the capital requirements and stress tests.

Stock market indexes that have reached record levels have benefited the wealth management units of banks such as JPMorgan.

At JPMorgan, fixed income trading soared 21 percent in the quarter to $5.6 billion, approximately $300 million higher than the amount predicted by the StreetAccount.

Equity trading increased 33 percent to $3.3 billion, also approximately $300 million higher than anticipated.

The investment banking charges increased by 16 percent to $2.6 billion and beat the $2.5 billion StreetAccount projection.

Dimon indicated that although the performance of all the major lines of business was satisfactory in the backdrop of a good economy, he was setting the firm to face potential turbulence in the future.

He said, “While there have been some signs of a softening, particularly in job growth, the U.S. economy generally remained resilient.”

Dimon further added, “However, there continues to be a heightened degree of uncertainty stemming from complex geopolitical conditions, tariffs and trade uncertainty, elevated asset prices, and the risk of sticky inflation. As always, we hope for the best, but these complex forces reinforce why we prepare the firm for a wide range of scenarios.”

The credit loss provision of JPMorgan increased by 9 percent to $3.4 billion, above the projected $3.08 billion, which shows that the company is anticipating greater loan defaults in the future.

However, this year, big banks have done much better than regional lenders; the KBW Bank Index has increased by almost 15 percent, whereas the KBW Regional Banking Index has fallen by approximately 1 percent.

Other companies that reported their earnings on Tuesday includes Goldman Sachs, Citigroup and Wells Fargo and Bank of America and Morgan Stanley reported their earnings on Wednesday.