Eli Lilly became the first U.S.-based health-care company to hit a valuation of $1trillion in the market capitalization, gaining entry to the exclusive club of tech companies.

Eli Lilly briefly surged to the $1 trillion mark in morning trading, but it retracted; it was recently trading at approximately $1,048 a share.

Eli Lilly is the second non-technology company to attain the desirable $1 trillion in the U.S. after Warren Buffett’s Berkshire Hathaway.

The stock of the drugmaker has surged over 36 percent this year, with investors celebrating the victories it has over the chief competitor, Novo Nordisk, in the GLP-1 drug space.

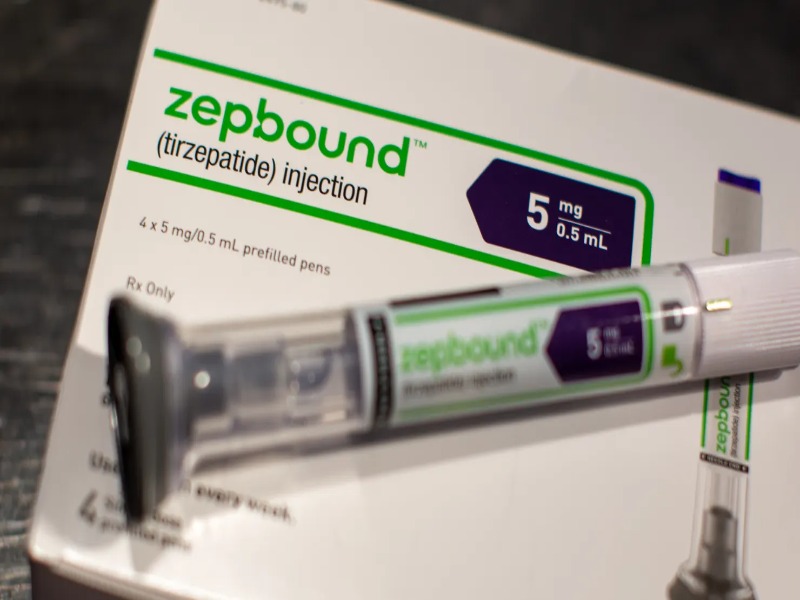

The stock of the Indianapolis-based company has been riding on the soaring popularity of its weight loss injection Zepbound and its type 2 diabetes treatment Mounjaro.

The two drugs have driven sales expansion for Eli Lilly. In the third quarter last month, the company claimed that Mounjaro attracted revenue of $6.52 billion, which is 109 percent higher than the revenue received last year.

However, Zepbound has recorded sales of $3.59 billion in the period, a 184 percent spike over the prior-year period.

The treatments will continue to increase in demand when usage approvals and insurance coverage are broadened.

Moreover, Eli Lilly is anticipating the oral form of its popular drugs to be released next year in the market, which will provide patients with an easier alternative to a shot that is easier to manufacture by the company.

Eli Lilly will probably continue playing a leading role in the weight loss drug market that, according to some analysts, may be valued at more than $150 billion by the early 2030s.

Nevertheless, with its recent challenges and change of leadership, Novo Nordisk is still an effective competitor of Eli Lilly in the space.

Pfizer had also stepped forward in the market when, earlier this month, it won a bidding battle of over $10 billion with obesity drugmaker Metsera and Novo Nordisk.

However, Eli Lilly struck the lottery with the approval of tirzepatide to manage diabetes in May 2022, which sells under the name Mounjaro. It began competing with the diabetes injection Ozempic by Novo Nordisk, which had already entered the market several years ago.

Meanwhile, Eli Lilly introduced a new way to treat diabetes and obesity. Tirzepatide works by imitating two hormones produced in the gut called GLP-1 and GIP. GLP-1 aids in lowering food consumption and hunger.

Hence, the GIP, which also suppresses appetite, may also improve how the body breaks down sugar and fat. The semaglutide of Novo Nordisk, the active ingredient in Ozempic and its weight loss drug Wegovy, only aims to GLP-1.

Mounjaro reached a “blockbuster” status, which refers to generating more than $1 billion in annual sales, at the time, its first full year on the market.

Eli Lilly gained approval of tirzepatide in late 2023, to treat obesity under the brand name Zepbound, and competes with Wegovy by Novo Nordisk.

Thus, Mounjaro attracted sales of $11.54 billion, and Zepbound generated sales of 4.93 billion by 2024.