Dubai property investments continue to outperform international markets, with 44 percent of homeowners reporting stronger returns in Dubai compared to their overseas portfolios. The insight comes from the Betterhomes Future Living Report 2025, which highlights a structural shift as the emirate cements its position as one of the world’s most stable and high-performing real estate markets.

Now in its second edition, the Future Living Report remains the only industry-wide study that examines resident behaviour, long-term ownership trends, and market sentiment beyond transactional data. The findings present a clear picture of a maturing real estate ecosystem driven by sustained demand, recurring income strength, and long-term investor confidence.

According to the report, Dubai’s ability to consistently deliver both capital appreciation and robust rental yields continues to set it apart from major global hubs. The city’s strong population growth, business-friendly regulations, and expanding base of long-term residents all contribute to the market’s resilience and sustained performance.

Strong Rental Yields And Rising Investor Confidence

Investor confidence remains high, with 87 percent of homeowners and landlords satisfied with current rental yields. This reflects the city’s strong recurring income environment, supported by stable tenancy demand and a broadening resident base.

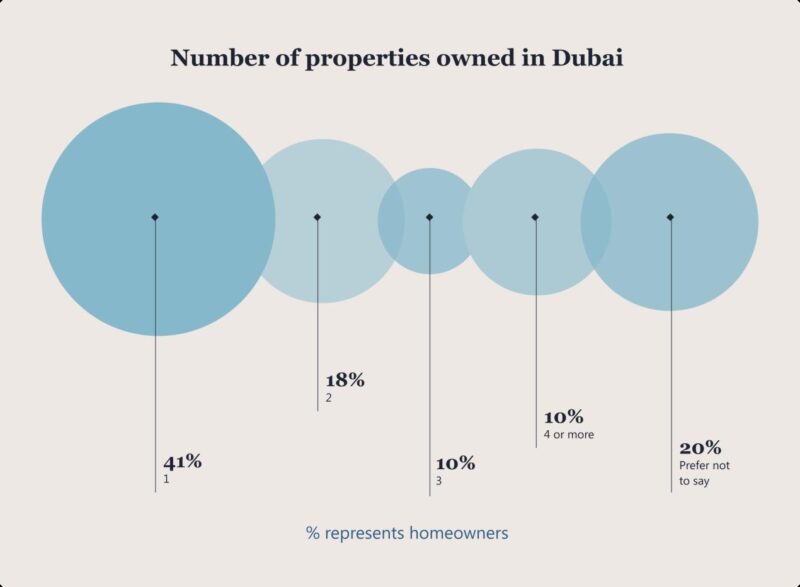

The report also shows that 30 percent of homeowners purchased their first property in Dubai more than 10 years ago, reinforcing the emirate’s long-term appeal. A maturing ownership base is visible across the findings: 41 percent of homeowners own a single property while 38 percent own multiple properties, indicating ongoing reinvestment and portfolio expansion within Dubai rather than overseas.

Together, these indicators point to a decisive trend. Investors are not only achieving better returns in Dubai; they are increasingly consolidating wealth within the emirate rather than diversifying into other markets.

“Dubai has moved far beyond being an emerging market story. When 44% of investors say their properties here outperform those they hold overseas, it signals a market operating at a genuinely global standard. Steady yields, long-term residency trends, and policy certainty are creating one of the most resilient real estate ecosystems anywhere in the world,” said Louis Harding, CEO of betterhomes.

Global Investors Continue To Choose Dubai Over Traditional Hubs

With respondents representing more than 90 nationalities, the survey reflects a wide global sentiment rather than regional concentration. The strongest buying intent originates from the United Kingdom, a highly sophisticated investor market with strong global influence. The diversified demand base underscores Dubai’s appeal as a stable, future-ready investment destination amid economic and geopolitical uncertainty in traditional international hubs.

The outlook remains optimistic. According to the report, 89 percent of homeowners believe Dubai will stand alongside London, New York, Singapore, and Hong Kong as a top-tier real estate market within the next five years. With nearly 200,000 new units expected by 2027 and continued capital inflows, Dubai’s position as a world-class property market is further accelerating.

The full Betterhomes Future Living Report 2025 is available for download at www.bhomes.com.