Michael Jordan’s NASCAR lawsuit proceedings are reshaping the conversation around team ownership, competitive fairness, and commercial rights in American motorsport. The case, brought by Jordan’s 23XI Racing team and Front Row Motorsports, challenges NASCAR’s charter system and could force significant changes to the business structure that underpins the sport. This legal battle highlights the ongoing issues within NASCAR and emphasizes the importance of fairness in competition, especially in light of the Michael Jordan NASCAR lawsuit.

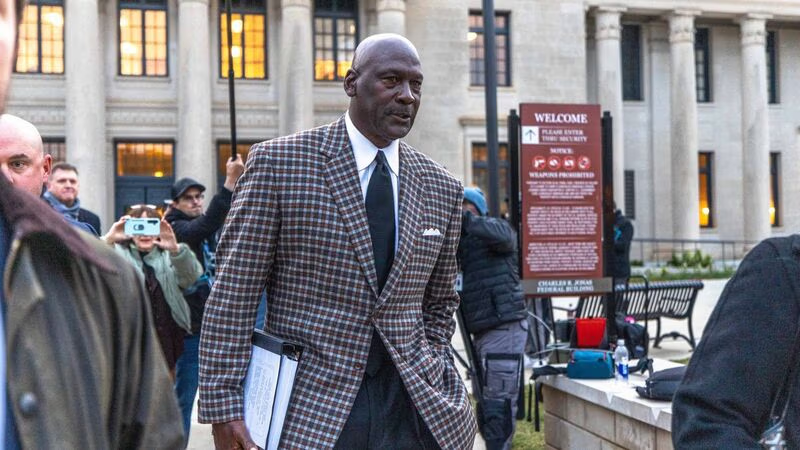

The dispute centres on NASCAR’s charter model, introduced in 2016, which grants a limited number of teams guaranteed entry into races and access to revenue streams. Jordan and his partners argue that the system offers neither long-term security nor actual ownership, despite significant financial investment. Jordan told the court he invested approximately USD 40 million in 23XI Racing under a structure he described as “lease-like,” offering “too little power with too much risk.” The implications of the Michael Jordan NASCAR lawsuit could redefine these agreements.

The implications of the Michael Jordan NASCAR lawsuit are far-reaching, and its outcome may influence future governance in the sport.

The teams declined to sign the 2024 charter renewal after objecting to restrictive terms, prompting the legal challenge and raising concerns that NASCAR’s model may violate antitrust standards by limiting competition. The outcome of the Michael Jordan NASCAR lawsuit may set a precedent affecting all teams and their operational strategies moving forward.

Internal Tensions Surface as Evidence Emerges

Court documents have revealed internal disagreements among NASCAR executives, team owners, and stakeholders, including disparaging comments and disputes over decision-making authority. Analysts argue these disclosures highlight deeper governance challenges within the sport’s operating structure.

NASCAR and some charter-holding teams have defended the system, stating it provides operational stability and competitive consistency. They argue that permanent, freely tradable franchise-style rights could undermine the league’s ability to enforce competitive rules and maintain organisational control.

High Stakes for the Future of Motorsport Ownership

If the plaintiffs succeed, NASCAR may be required to reform its charter model and potentially grant permanent, transferable ownership rights similar to those in the NFL, NBA, or Premier League. Such a shift would alter the valuation of racing teams, reshape investment incentives, and open the door for institutional capital seeking long-term assets with predictable returns.

Monetary damages could also be substantial, potentially tripling under US antitrust law. A ruling favouring Jordan and his partners would strengthen protections for smaller or newer teams that have a less secure footing under the current model.

If NASCAR prevails, 23XI Racing and Front Row could face financial and competitive challenges, reinforcing the dominance of established charter holders and limiting new entrants.

Global Implications for Sports Investors and Franchise Models

The case is being watched closely by investors and sports executives worldwide, including in the Gulf region, where franchise valuations and sports ownership stakes have risen sharply across football, motorsport, mixed martial arts, and entertainment properties.

A ruling that weakens or restructures NASCAR’s centralised control model could inspire similar challenges in other racing series or sports that operate through licensing rather than franchise rights. It would also strengthen the argument for investor-friendly governance frameworks that prioritise transparency, long-term asset rights, and commercial protection.

A Verdict with Industry-Wide Impact Ahead

The trial is now in a critical stage as a jury evaluates claims, contract structures, and evidence. A decision is expected to influence not only NASCAR’s internal operations but also broader discussions about ownership models, competition policy, and the economic sustainability of motorsport teams.

Regardless of the outcome, the lawsuit has already placed a spotlight on the shifting dynamics between sporting bodies, private investors, and the growing expectation for franchise-style value security across global sports markets.