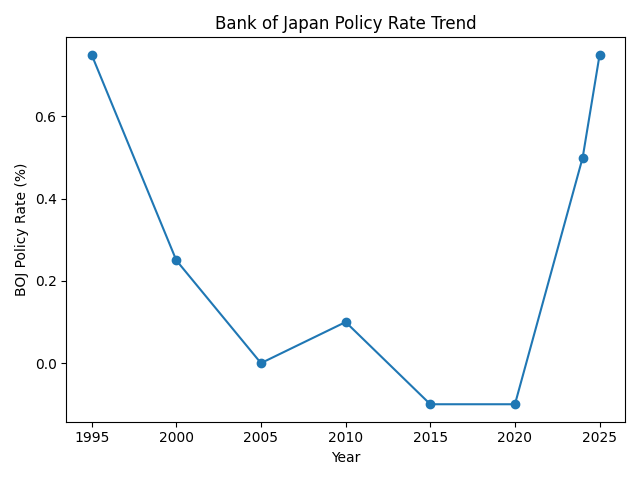

Japan rarely dominates global monetary policy conversations. For decades, its ultra-low interest rates were treated as an exception rather than a signal. That is why the Bank of Japan’s decision to raise its policy rate to 0.75 percent deserves attention, not just in Tokyo, but across global markets.

This level may seem modest by international standards, yet it represents Japan’s highest benchmark rate in nearly 30 years and another clear step away from the extraordinary stimulus that defined its economy since the 1990s. More importantly, it changes long-held assumptions about how capital flows through the global financial system.

A Break From a Long Era of Easy Money

Japan spent years battling deflation and weak growth, keeping interest rates near zero while other major economies cycled through tightening and easing phases. That policy encouraged borrowing, supported exports, and pushed domestic investors to seek returns overseas.

The current shift reflects a different reality. Inflation in Japan has proven more persistent than policymakers initially expected, pressuring household budgets and forcing the central bank to reassess its stance. While the Bank of Japan remains cautious, the direction of travel is no longer in doubt.

The Yen And Global Risk Appetite

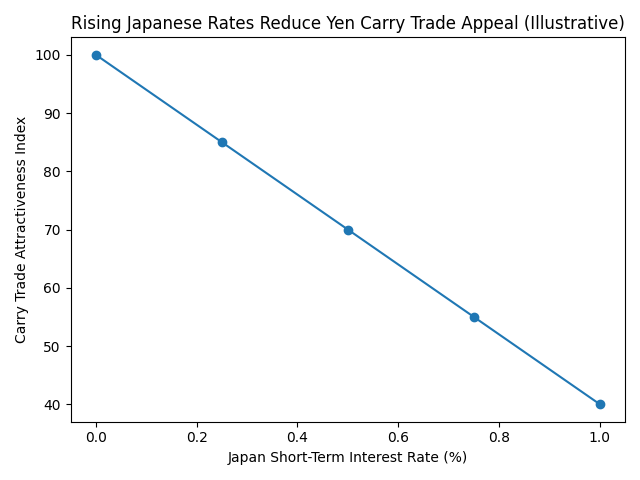

One of the most immediate global effects of higher Japanese rates is felt through the yen. Low rates made the currency a popular funding tool for global investors. Borrowing in yen to invest in higher-yielding assets abroad became a common strategy across hedge funds and institutional portfolios.

As Japanese rates rise, that trade becomes less attractive. A stronger yen increases borrowing costs and reduces returns, prompting investors to unwind positions. When that happens quickly, it can amplify volatility across stocks, bonds, and alternative assets worldwide.

History shows this clearly. Periods of market stress often coincide with rapid reversals in carry trades, forcing asset sales that deepen price swings even when the original shock starts elsewhere.

Japanese Investors And Global Bond Markets

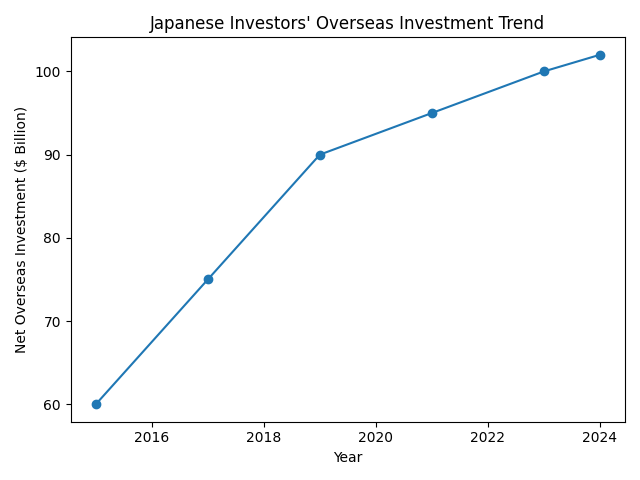

Another longer-term channel lies with Japanese savers and institutions. Pension funds, insurers, and retail investors spent years allocating capital to U.S. Treasurys, European bonds, and global equities in search of yield.

Rising domestic rates gradually change that calculation. As Japanese government bonds and local assets become more competitive, some investors may choose to bring money home. Even a modest reallocation can matter, given the scale of Japan’s overseas holdings.

If global bond demand softens, yields rise. That affects borrowing costs for governments, companies, and households across major economies. Mortgage rates, corporate debt issuance, and fiscal financing all respond to shifts in bond yields, regardless of where the initial policy change occurs.

Not A Shock, But A Signal

It is important to note that this is not a sudden tightening cycle. The Bank of Japan has communicated its intentions carefully, and most economists expect any further increases to be gradual. Japan’s economy remains sensitive to higher borrowing costs, and policymakers are aware of the risks of moving too far, too fast.

Still, the signal matters. Japan is no longer the anchor of ultra-cheap global liquidity it once was. That alone alters how investors think about risk, funding, and long-term capital allocation.

Why Global Investors Should Pay Attention

In a world where monetary policy paths are diverging, Japan’s slow exit from extraordinary easing adds another layer of complexity. While the U.S. debates rate cuts and Europe navigates uneven growth, Japan is cautiously tightening.

For global investors, this means reassessing assumptions that have held for decades. Cheap funding is no longer guaranteed. Capital may become more selective. Volatility may surface in unexpected places.

Japan’s rate hike may look small in isolation, but its implications stretch far beyond its borders. Sometimes, the most important market shifts are not the loudest ones, but the ones that quietly change the rules everyone had grown used to.