Portfolio Manager Luke Newman argues how, in today’s uncertain environment, investors can leverage stock dispersion to turn market chaos into profitable opportunities.

The majority of 2025 thus far has been marked by fears over the perilous state of sovereign debt across the developed world, tariff risk, AI hype, the role of central banks, geopolitical uncertainty, challenges to political norms, resurgent inflation… it has not been hard to identify risks wherever you look. But despite periods of volatility, equity markets have continued to rally, reaching ever-higher multiples.

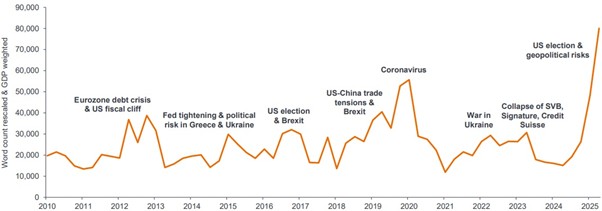

So where are we now? Despite the fear of missing out (FOMO) that has been driving markets to show such resilience and strength, uncertainty remains rife. That word ‘uncertainty’ really encapsulates how this market looks (Exhibit 1). Undoubtedly, this is a challenge for investors, whether that applies to running a strategy, advisors managing a portfolio of behalf of their clients, or direct investors. With this level of uncertainty in the world, keeping an eye on diversification and risk mitigation seem relevant.

Exhibit 1: Riding the news rollercoaster

Source: H Ahir, N Bloom, D Furceri (2022), “World Uncertainty Index”, NBER Working Paper, as at 30 June 2025. The index reflects the frequencies of the word uncertainty (and its variants) in the Economist Intelligence Unit (EIU) quarterly country report.

Evolving market environment – the ‘normalisation’ factor

It seems banal to argue that borrowing should have a cost, but investors had become so used to the post-financial crisis environment where ‘forever low’ interest rates meant the cost of borrowing for governments and major corporation was negligible. The reassertion that debt should be a more discerning choice, rather than, for example, a safety net that kept poorly managed businesses afloat for longer (so-called “zombie” companies), means that we are seeing real distinction between companies once more coming to the fore.

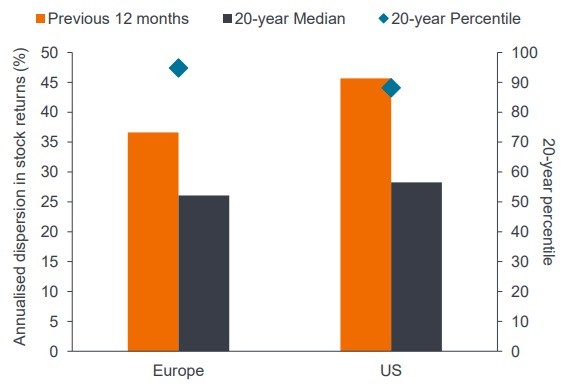

For active equity stock pickers, seeing a return of stock dispersion like this (Exhibit 2) is fantastic news. In a world where fundamentals matter, margin structure, quality of management, upgrades, downgrades relative to valuation, etc, stock selection becomes more important. You no longer see whole swathes or sectors of the market moving within a tight range of each other. It becomes less about single-factor strategies, such as the ‘growth versus value’ decision that defined much of the past decade, overlooking all other factors or styles. It opens the door to fundamental analysis driving stock selection; seeing what edge you can find, in terms of a company’s strategy or its prospects, and then marrying that to valuation.

Exhibit 2: Stock dispersion is much higher than it has been in recent years

Source: Morgan Stanley Alpha, FactSet, as at 26 August 2025. RHS as at 30 June 2025.

Pair trades – how to make a market neutral position work harder

Long/short investing is not just a question of which call to make about going long or short on a stock, industry or sector. There are distinct characteristics to this asset class that provide investors with a broader tool set to generate performance. Pair trading, for example, in simple terms is a market neutral strategy where investors take a long position in one company (or security) they believe is undervalued, and a short position in another stock (or security) that they believe is overvalued, within the same industry. The purpose is to profit from any relative price movement between two historically correlated securities, rather than the overall market. Right now, this is an area where we see a wealth of opportunities, reflecting elevated pricing dispersion between rival companies within the same industry.

How could this work in function? For example, although companies like Coca-Cola and Pepsi are two very similar consumer product businesses, the differences are significant enough to create potential for a pair trade. Coca-Cola has an outsourcing beverages-focused strategy, selling concentrates and syrups to independent bottlers, while Pepsi pursues a more diversified drinks and snacks strategy, with an insourced production model that gives it greater control over its supply chain and distribution.

Depending on where an investor sees the opportunity, in terms of pricing, profitability and market opportunity, it is possible to take a long position in one of these stocks, and a short position in the other. This kind of trade is an example of the interesting things you can do when combining long and short positions, to really lean into the stock-specific opportunity, while still retaining sensitivity to broader market factors that affect both companies.

An environment richer in opportunities on both the long and short side

Financial markets have contended with significant volatility throughout 2025. A year of such dramatic changes at a macroeconomic and geopolitical level has ushered in a period of constant reassessment, in terms of where the best opportunities lie.

In Europe, we have seen the EU reacting to a new order for international trade, and defence. Non-U.S. NATO spending is rising, particularly in Germany, where we are seeing major government investment, partnering with corporations to kickstart Europe’s largest economy. European defence companies were trading at a discount to U.S. names, but investors have really started to pay attention to this area. In the UK, banks and insurers have benefited from inflation that has remained persistently sticky. We still see the UK as a global play, given the international exposure of the UK stock market, but it is also an area where stock selection can be really important, with individual stocks offering real potential on the long side.

In the U.S., U.S.Treasury Secretary Bessent caution in March this year that the U.S. may slow as part of a “detox”, dure to cutbacks on government spending (the ‘DOGE’ factor). The change in rhetoric since then provides an interesting insight, with Bessent pivoting from talking about cuts, towards higher spending that is geared towards stimulating the economy – the so-called ‘run it hot’ strategy. Certainly, a cooling U.S. labour market gives space for the U.S. Federal Reserve to cut interest rates further than it has, which Trump has pushed hard for, despite inflation concerns. We see this as an interesting setup for the U.S., with broader ramifications globally, which continues to frame our views on exposure, in terms of both the long and short side.

Conclusion

Historically, equity long/short strategies have been used in lots of different ways, as a kind of lower-risk equity substitute, and from the fixed income side for those investors attracted by an asset class that has historically shown similar levels of volatility to sovereign fixed income. We think sustained pricing dispersion is a good long-term proposition, but a key component of that view is that it is not dependent on a sustained bull market. It doesn’t rely on just the dominant theme of big technology (artificial intelligence) to continue to drive performance.

In our view, this is arguably the best environment for a decade, in terms of opportunities for an equity long/short strategy. Long/short strategies have the potential to thrive during chaos, in terms of opportunities, turning volatility into opportunity and risk into reward. And with stock dispersion elevated, and fundamentals driving share prices, it means that we are seeing alpha driving performance, rather than market beta, in a market regime we expect to persist. If stock pickers have the right valuation approach, the right flexibility and the right access, this is a great environment to differentiate performance from a peer group, or passive investments.

Attributed to: Luke Newman, Portfolio Manager on the Absolute Return Equities Team at Janus Henderson Investors