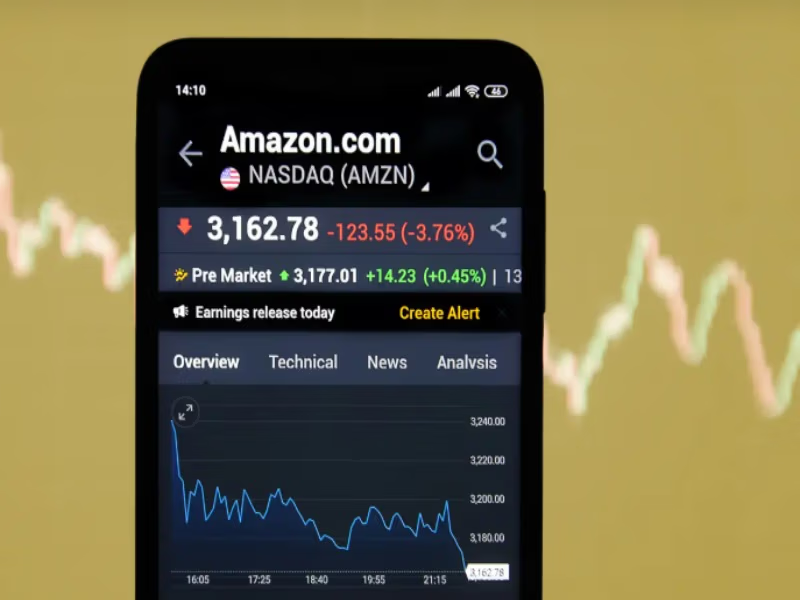

Amazon stocks dropped more than 10 percent in extended trading on Thursday following the company’s reporting mixed fourth-quarter revenue and increasing its 2026 spending expectations to $200 billion.

This is the performance of the company, as against an estimate done by analysts polled by LSEG: Earnings per share is $1.95 in comparison to the $1.97 estimation. Revenue valued up to $213.39 billion compared to the $211.33 billion estimation.

According to StreetAccount, Wall Street is also seeking other key revenue numbers. Amazon Web Services is worth up to $35.58 billion compared to $34.93 billion. Advertising is valued to $21.32 billion compared to the $21.16 billion expectation.

Amazon noted that it anticipates capital spending to keep mounting higher in the current year as it actively invests in data centers and other infrastructure to handle an artificial intelligence demand spurt.

FactSet reported that the company estimated capex to reach $200 billion this year, while analysts were expecting $146.6 billion. Amazon had a capital expenditure of about $131 billion in 2025.

CEO Andy Jassy said in a statement, “With such strong demand for our existing offerings and seminal opportunities like AI, chips, robotics, low earth orbit satellites, we expect to invest about $200 billion in capital expenditures across Amazon in 2026, and anticipate strong long-term return on invested capital.”

While conference call with investors, Jassy stated that spending would “predominantly” go to AWS, where non-AI workloads are “growing at a faster rate than we anticipated.” Amazon released an $11 billion AI data facility, Project Rainier, designed specifically to execute Anthropic workloads last October.

Jassy added, “We have very high demand. Customers really want AWS for core and AI workloads, and we’re monetizing capacity as fast as we can install it.”

Technology firms have also put forward ambitious spending budgets on artificial intelligence, promising to spend billions of dollars.

Google’s parent company, Alphabet, announced on Wednesday that it anticipated between $175 billion and $185 billion of capital expenditure in 2026, whereas that capital expenditure at Meta might increase almost three times in 2026 to approximately between $115 billion and $135 billion.

The cloud computing business in Amazon also grew its revenue by 24 percent in the fourth quarter, which is above the 21.4 percent growth forecasted by analysts. Jassy said it was AWS’s “fastest growth in 13 quarters.”

Even though Amazon is the leader in cloud infrastructure, the company has been struggling to combat the notion that it is losing to Google and Microsoft in the market. Microsoft Azure expanded by 39 percent last week. Google grew by approximately 48 percent in cloud revenue, the maximum rate since 2021.

In the present quarter, Amazon indicated that it is projected to have sales of between $173.5 billion and $178.5 billion, which is an 11-15 percent growth. Analysts polled by LSEG were expecting $175.6 billion.

Net income for the fourth quarter was $21.19 billion, or $1.95 per share, compared to $20 billion, or $1.86 per share, in the previous year. The findings are at a time when Amazon is still reducing its number of employees.

The company announced last week it would lay off approximately 16,000 corporate workers, following the reduction of approximately 14,000 workers in October.

Amazon employed 1.57 million people around the world at the end of the day, corresponding to a 1 percent growth year-to-year. That figure is primarily comprised of its warehouse workforce.

The advertising business of the company is still keeping a steady hum. The revenue expanded 23 percent year-over-year to $21.3 billion during the quarter.