India’s IPO market has roared back to life in 2025, with a string of billion-dollar listings capturing global attention.

Yet beneath the headline figures lies a more nuanced reality: strong initial enthusiasm, especially for big issues, has not always translated into sustained investor gains. This has left both retail and institutional investors asking a crucial question: Are mega IPOs simply hyped events, or do they deliver genuine long‑term value?

Strong Initial Demand and Listing Day Performance

One of the most striking features of the IPO landscape this year has been the performance of large offerings. Data shows that mega IPOs, those above ₹5,000 crore (roughly $600 million), have significantly outperformed smaller listings at debut.

According to recent market analysis, big issues delivered average first‑day gains of around 22%, nearly three times the 7.5% seen in smaller IPOs, and notably above broader market averages, the Economic Times reported.

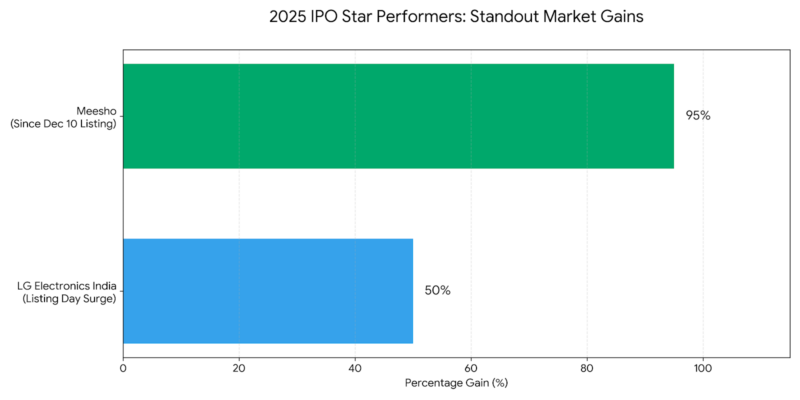

Standout examples include LG Electronics India, which saw its stock surge nearly 50% on its trading debut, driven by overwhelming investor demand and strong subscription levels. Meanwhile, high‑growth e‑commerce platform Meesho became one of the best‑performing large IPOs of 2025. Since its December 10, 2025 listing, Meesho’s shares have jumped nearly 95% from the issue price, creating substantial investor wealth and vaulting co-founder and CEO Vidit Aatrey into the billionaire club.

This pattern suggests that, at least in the short term, mega IPOs can generate impressive gains. Higher profile, established brands, and deep institutional participation tend to support stronger price discovery and liquidity on debut, which benefits both retail and institutional participants.

Investor Interest and Subscription Trends

While record fundraising and strong subscription numbers highlighted the early enthusiasm, retail investor oversubscriptions have moderated compared to last year. The average subscription rates dipped from around 33x to roughly 27x of available shares, The Financial Express reported.

At the same time, industry data show that average listing gains across all IPOs have shrunk notably, with the mean first‑day uplift under 10% in 2025 compared with much higher gains in prior years. This combination of moderated subscription and lower average debut gains highlights a maturing market that is recalibrating expectations.

Long‑Term Performance: The Reality Beyond the Debut

The more meaningful test for IPOs lies beyond the opening bell. While initial pops grab headlines, a growing body of market evidence shows that many newly listed stocks fail to sustain those early gains over the medium to long term.

Historical analysis suggests that although average listing-day gains may exceed 20%, those returns often fade to single-digit annualised levels within a couple of years as post-IPO volatility, earnings delivery and broader market conditions assert themselves.

Past cycles offer a useful reference point. For example, in July 2021, Zomato (Eternal) surged 51.3% reflecting investor optimism about the food delivery sector, according to a Livemint report. Yet the broader pattern since then shows that initial enthusiasm alone is rarely sufficient to guarantee durable wealth creation.

Data from 2025 reinforces that message. This year, 51 IPOs listed, with 37 delivering positive listing-day returns averaging 12.66%. Performance, however, was far from uniform. Amanta Healthcare and NSDL recorded gains of 12.50% and 17.00% respectively.

Research into India’s tech-heavy listings between 2020 and mid-2025 shows that only about 32% of new-age IPOs delivered long-term gains for post-IPO investors, despite many posting strong debuts. Another market snapshot from independent data suggests that while many IPOs list above their offer price, only about half remain above their issue price months after debut, meaning investors chasing short‑term gains often face disappointment when excitement fades.

Case Studies: How India’s Biggest IPOs Are Actually Trading

Recent billion-dollar listings illustrate just how wide the gap can be between IPO hype and post-listing reality.

Hyundai Motor India made history with the largest IPO ever in the Indian market, raising ₹27,858 crore ($308.8 Million) when it debuted in October 2024 at an issue price of ₹1,960 ($22). Investor interest was intense, and the stock initially found support. However, recent months have seen that optimism fade. After a brief recovery rally, Hyundai Motor India has slipped back under pressure and now trades around 7% below its issue price, bringing to focus how even marquee global names are vulnerable once initial excitement subsides.

The starkest warning sign among mega listings remains One 97 Communications, the parent of Paytm. Its ₹18,300 crore ($203 million) IPO was one of India’s most anticipated, but regulatory scrutiny and profitability concerns quickly weighed on the stock. Shares plunged as much as 80% from the issue price, bottoming near ₹350 in May 2025. Although the stock has recovered some ground, it still trades more than 27% below its IPO level, cementing its status as a cautionary tale for investors chasing scale over sustainability.

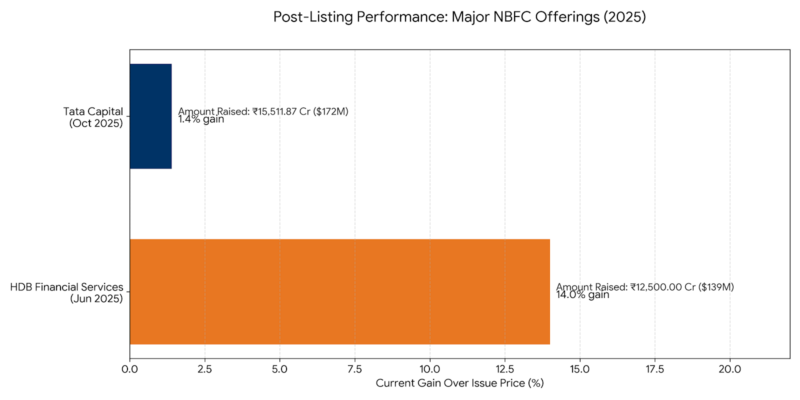

However, not all large IPOs have disappointed. Tata Capital, the Tata Group’s NBFC arm, raised ₹15,511.87 crore ($172 million) in October 2025 and has managed to hold modest gains, currently trading about 1.4% above its issue price. HDB Financial Services, which raised ₹12,500 crore ($139 million) in June 2025, has fared slightly better, with shares up around 14%, though momentum has remained subdued relative to the size of the offering.

Meanwhile, consumer-tech listings show mixed durability. Swiggy, which raised ₹11,327 crore ($125.50 million), posted a modest listing gain of about 7.7%. The stock rallied in early 2025 but later lost momentum, and now trades roughly 17% above its issue price — respectable, but far from the explosive wealth creation many investors expected.

What This Means for Retail Investors

So, are mega IPOs overhyped? The evidence suggests the answer depends on investment horizon and expectations:

- Short‑term gains: Large IPOs today are often well‑subscribed and show strong listing pops, especially when backed by recognizable brands and institutional support. This can benefit retail investors who exit quickly.

- Medium to long term: Sustaining those gains requires solid business economics, growth prospects, and market conditions. Many high‑profile IPOs fail to deliver meaningful returns beyond the initial rally, illustrating that IPO enthusiasm alone isn’t enough to build wealth.

What’s clear for 2025 is that mega IPOs can still deliver value, especially at debut, but they are not a guaranteed wealth creation vehicle for all investors. Strong first‑day performance and heavy subscription may reflect market excitement, but true value depends on fundamentals and long‑term performance.

For retail investors, this suggests the importance of due diligence and long‑term perspective over chasing headline IPO returns. In a market where initial pops are no longer as dramatic as in previous years and where long‑term gains are less certain, selectivity and a focus on business quality matter more than ever.