Barq has solidified its role as the quickest advancing digital wallet in the area in terms of downloads and usage counts, by attaining record-breaking adoption milestones within an unprecedented timeframe.

Barq has already achieved one million users in less than a month since its launch, which is a record performance unheard of in the market as of today, and certainly not by any other digital wallet to date.

The platform maintained its rapid headway by amassing more than seven million users within less than a year and subsequently rising to more than 10 million users within 17 months of operation.

The company has led a remarkable growth trend in the context of a larger upward trend in the digital payments ecosystem of Saudi Arabia.

The cumulative worth of the e-payments enterprise in the Kingdom has increased over twenty times in the last four years, increasing by about SR9 billion ($2.4 billion) in 2020 and reaching close to SR315 billion ($84 billion) by the year 2024.

According to market indicators, Barq has been a key beneficiary of this regional digital payments boom. As adoption has now taken over about one-third of Saudi Arabia, and it is moving faster across the national boundaries, the app has surpassed other competitors in terms of acquiring users faster than they have in the region.

However, the performance highlights the quick transition to cashless transactions and makes Barq one of the main fintech leaders in the Middle East. With a license granted by the Saudi Central Bank (SAMA), Barq has experienced continuous growth due to increasing consumer confidence in licensed digital financial solutions.

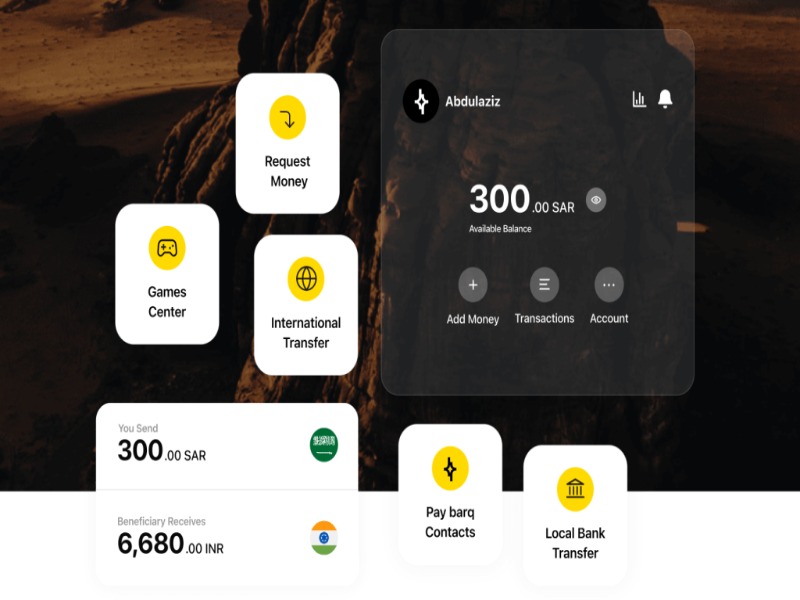

The app will be developed based on a mobile-first platform and will be aimed at both individual customers and small-to-medium enterprises (SMEs), which are one of the pillars of the regional economy.

Saudi Arabia is striving to achieve the goals of Vision 2030, and the growth of Barq is taking center stage in transforming the financial environment. The increasing financial inclusion and enrichment of the capabilities of high-level cross-border payments are reinforcing the transition of the region into a modern, highly technological financial system with an international scope.