Bitcoin soared to a record high of around $124,000 on August 14, 2025, cementing its status as the world’s largest cryptocurrency and marking a new milestone in its 16-year journey.

Bitcoin’s New Peak

According to market trackers, Bitcoin traded as high as $124,002.49 on Thursday, with CoinGecko reporting a peak of $123,561, underscoring unprecedented investor demand

The surge places Bitcoin well above its previous cycle highs, reinforcing its position as a mainstream financial asset.

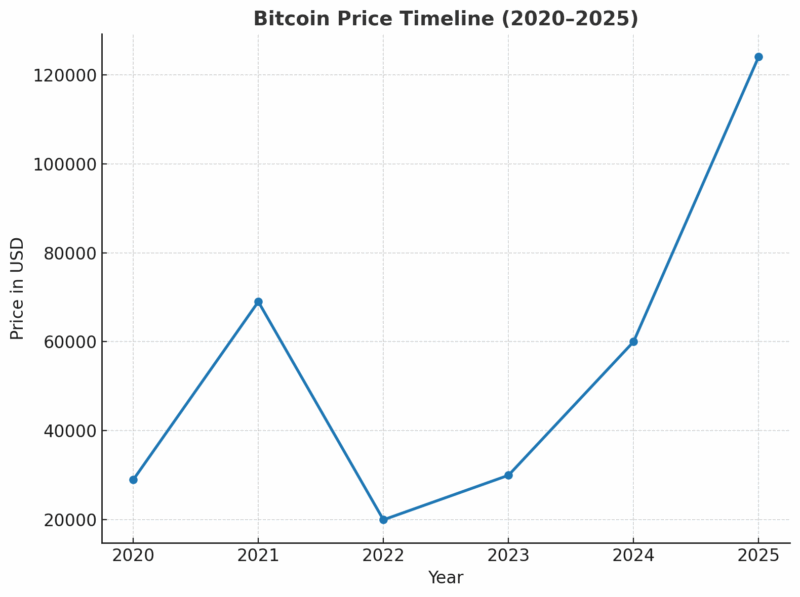

2020: Bitcoin trades near $29,000 as institutional adoption begins.

2021: Surges to $69,000, driven by retail mania and corporate adoption.

2022: Crashes to $20,000 amid Fed tightening and crypto market scandals.

2023: Stabilises around $30,000, marking recovery phase.

2024: Climbs back to $60,000 ahead of ETF approvals and halving buzz.

2025: Hits $124,000, boosted by Fed easing bets, U.S. pro-crypto policies, and institutional inflows.

What’s Driving The Rally?

Several key factors are fueling Bitcoin’s meteoric rise:

- U.S. Federal Reserve policy: Expectations of interest rate cuts have pressured the U.S. dollar, boosting demand for risk assets like crypto

- Trump-era crypto policies: President Donald Trump has introduced pro-crypto measures, including a U.S. Strategic Bitcoin Reserve and regulatory openness toward Bitcoin in retirement accounts

- Institutional inflows: Spot Bitcoin ETFs have drawn billions in investment, giving traditional institutions easier access to the digital asset

Analysts See More Upside

Optimistic projections suggest Bitcoin could climb to $150,000–$200,000 by the end of 2025, as institutional adoption accelerates and global acceptance widens

From Zero To $124,000

Launched in 2009, Bitcoin started with virtually no market value. Today, its climb to more than $124,000 per coin underscores one of the most remarkable asset journeys in modern financial history.