Chief Investment Strategist of APAC at BlackRock, Ben Powell, said that the wave of capital flow into artificial intelligence infrastructure is not yet over, but that the so-called sector’s “picks and shovels” suppliers of chipmakers to energy producers and copper-wire manufacturers are the most obvious winners as hyperscalers rush to outbid each other.

Powell informed CNBC on Monday that on the sidelines of the Abu Dhabi Finance Week, the AI-related capital spending boom has not yet come to an end, with tech giants actively striving to gain an advantage in what they consider a winner-takes-all contest.

He said that “The capex deluge continues. The money is very, very clear,” and citing that BlackRock has aimed on what he called a “traditional picks and shovels capex super boom, which still feels like it’s got more to go.”

The AI infrastructure has been among the largest sources of investment in the world this year, which has contributed to a wider market runup, despite investors doubting the sustainability of the boom.

Nvidia, with its GPU chips, the engine of the AI revolution, became the first company to briefly reach a $5 trillion market capitalization amid a dizzying AI-driven market run-up that bred discussions of an AI bubble.

Microsoft and OpenAI also agreed to a restructuring agreement in order to aid in fundraising by the ChatGPT developer in October. According to Reuters, OpenAI has been gearing up to make an initial public offering that would give the company a valuation of $1 trillion.

The construction has triggered the protracted procurement processes within the technology industry, including chip supply deals also power contracts. U.S. to Middle East grid operators are scrambling to keep pace with skyrocketing electricity demand from new data centers.

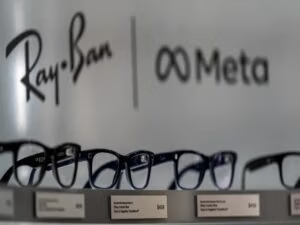

However, the companies, such as Amazon and Meta, have allocated tens of billions of dollars for AI-related investments annually.

According to S&P Global, data-center power demand is projected to almost double by 2030, primarily due to hyperscale, enterprise, and leased centers, and crypto-mining centers.

Powell also reported that the major tech companies have just started to access capital markets to fund the next stage of AI growth, which implies more capital access ahead.

He stated that “The big companies have only just started dipping their toes into the credit markets… feels like there’s a lot more they can do there.”

Powell added that the “hyperscalers” are acting as if reaching second would effectively leave them out of the market. He noted that the companies are driven to spend faster than ever at the risk of going overboard.

Powell reported that much of that capital will probably be directed to the firms that drive the AI build-out, and not at model developers, confirming an emerging belief among global investors that the most durable gains to the AI boom can be found in the hardware, energy, and infrastructure ecosystems that underlie the technology.

“If we’re the recipients of that cash flow, I guess that’s a pretty good place to be, whether you’re making chips, whether you’re making energy all the way down to the copper wiring,” Powell noted, expecting “positive surprises driving those stocks in the year ahead.”