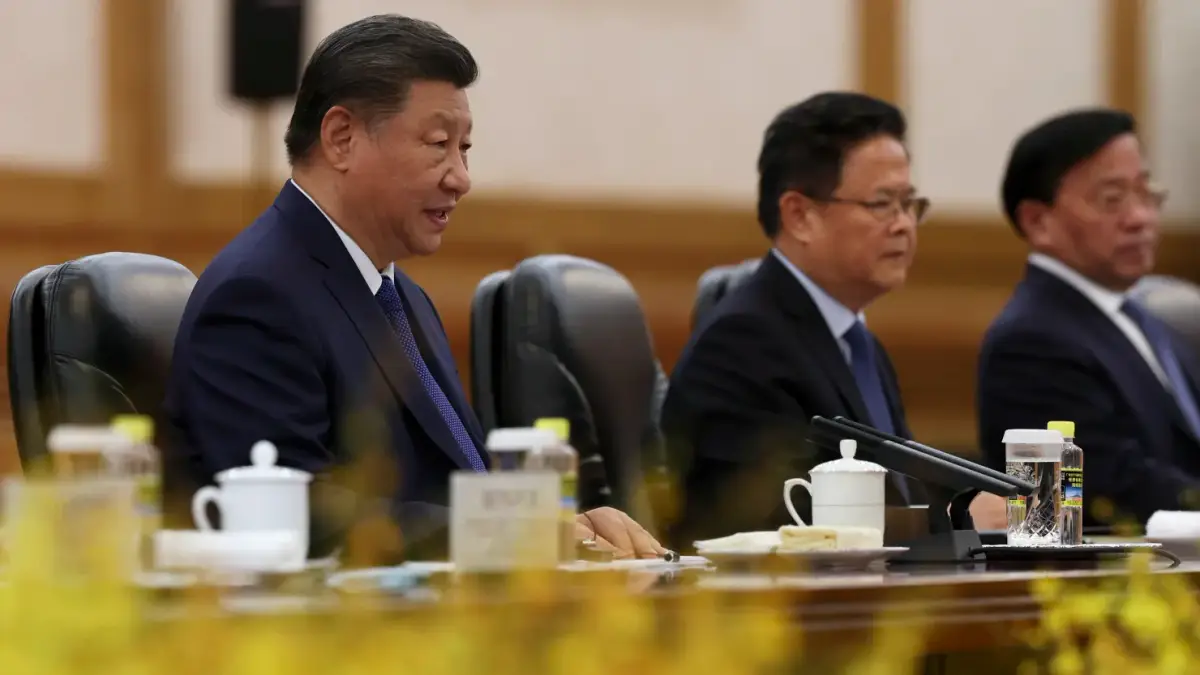

China’s leaders have underscored their commitment to boosting economic growth during a high-level annual economic planning meeting led by President Xi Jinping. The event, which concluded Thursday, outlined plans for proactive fiscal policy, increased deficit spending, and the issuance of ultra-long bonds in 2025, according to state-run CCTV.

The meeting also reinforced the use of “moderately loose” monetary policy, a term not seen since the 2008 global financial crisis, reflecting heightened urgency to address persistent economic challenges. These include a slowing domestic economy and escalating external pressures, such as a potential trade war with the U.S., as Donald Trump prepares to take office again in January.

Focus on Domestic Growth and Global Competitiveness

The Politburo, China’s second-highest decision-making body, echoed similar sentiments earlier this week, vowing to deploy “unconventional counter-cyclical adjustments” to boost consumption and investment. State media reports emphasized shifting focus from the industrial sector to enhancing domestic demand through consumption and effective investment.

“China’s pivot underscores the pressing need to strengthen internal drivers of growth amid mounting external uncertainties,” noted Bruce Pang, chief economist of Greater China at JLL.

Key initiatives discussed include:

- Supporting technological innovation.

- Expanding domestic consumption through targeted subsidies and incentives.

- Gradually opening up the economy, including relaxed visa requirements for select countries.

However, specific figures and policies will only be disclosed at the National People’s Congress in March.

Mixed Investor Sentiment on Stimulus Plans

The iShares China Large-Cap ETF (FXI) saw premarket gains of 0.8% following news of the meeting but later pared back gains as markets digested the report’s cautious tone.

Economists remain cautiously optimistic. “The direction of policies is clear, but the size of stimulus matters,” said Zhiwei Zhang, chief economist at Pinpoint Asset Management. “More aggressive measures might be required, especially if the U.S. imposes new tariffs on Chinese goods.”

Chinese officials have already implemented several stimulus measures since late September, including:

- Interest rate cuts.

- Looser property purchase rules.

- Liquidity support for stock markets.

- A 10-trillion-yuan ($1.4 trillion) stimulus package to alleviate local government debt.

Despite these efforts, recent data indicate persistent deflationary pressures. November’s consumer inflation fell to a five-month low, while the Producer Price Index (PPI) contracted for the 26th consecutive month, underscoring challenges to reviving economic momentum.

Beijing is expected to maintain its GDP growth target at “around 5%” for 2025, mirroring this year’s goal. Some economists predict a higher budget deficit target of up to 4% of GDP, enabling increased government borrowing to fund economic recovery initiatives.

China’s leaders are also expected to expand policy tools aimed at spurring domestic consumption, including subsidies for household goods and measures to improve consumer confidence.

Zhang views the latest policy signals as a significant shift, stating, “The changes this week are more pronounced than those introduced in late September.”

However, sustained market recovery hinges on whether upcoming fiscal and monetary actions are sufficient to offset ongoing deflationary pressures and global economic headwinds.