Delivery Hero SE, the German food delivery giant, is preparing for one of the Middle East’s largest initial public offerings of 2024 by seeking approximately $1.5 billion through the listing of its regional unit, Talabat, in Dubai. Sources familiar with the matter revealed that Delivery Hero aims to achieve a valuation of around $10 billion for Talabat by selling a 15% stake while retaining majority ownership.

The IPO, expected to debut on the Dubai Financial Market on December 10, has already garnered significant attention. A price range for the offer is set to be announced Tuesday. If successful, the deal would add to the $10 billion raised in the Middle East from new share sales this year, solidifying the region’s standing as a global IPO hotspot despite some recent lackluster debuts.

Talabat’s growth trajectory and robust margins have positioned it as the “crown jewel” of Delivery Hero’s portfolio, according to Bloomberg Intelligence’s Tatiana Lisitsina. This competitive edge could justify a valuation premium even amid mixed regional IPO performance. Recent listings like Lulu Retail’s $1.7 billion IPO in Abu Dhabi and a $2 billion offering by Oman’s state energy firm faced muted debuts, with the latter closing 8% below its offer price.

Talabat’s IPO prospectus outlines plans to distribute dividends beginning in April 2025, with $100 million allocated based on fourth-quarter results. Further payments of $400 million are scheduled for October 2025 and April 2026. Moving forward, dividends will be disbursed biannually, with the company targeting a 90% payout ratio of its net income.

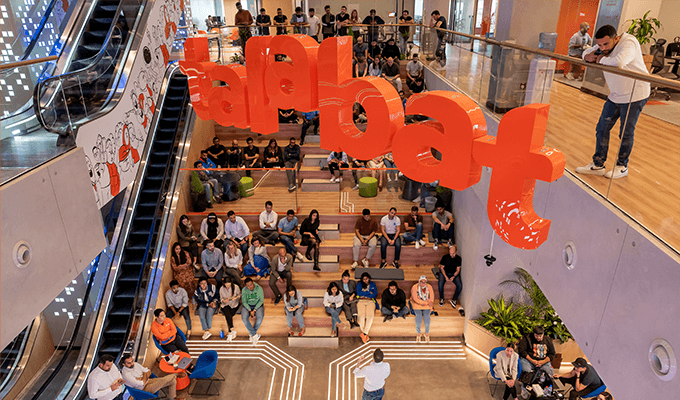

Operating across eight countries, including the UAE, Kuwait, Qatar, and Egypt, Talabat has solidified its market leadership in the region. Key acquisitions, such as Zomato’s UAE food delivery business in 2019 and online grocery platform InstaShop in 2020, have bolstered its presence.

The IPO will be managed by a consortium of global and regional financial powerhouses. Emirates NBD Capital, JPMorgan Securities, and Morgan Stanley are serving as joint global coordinators and bookrunners, with additional support from Abu Dhabi Commercial Bank, Barclays, EFG-Hermes, First Abu Dhabi Bank, Goldman Sachs, ING Bank, and UniCredit.

As Delivery Hero gears up for the listing, the Talabat IPO underscores the Middle East’s growing prominence in global capital markets and highlights Dubai’s role as a key player in regional financial activity.