Emirates NBD, a leading banking group in the Middle East, North Africa and Türkiye (MENAT) region, has successfully concluded a major fraud awareness campaign marking a significant shift in how banks educate customers about financial crime.

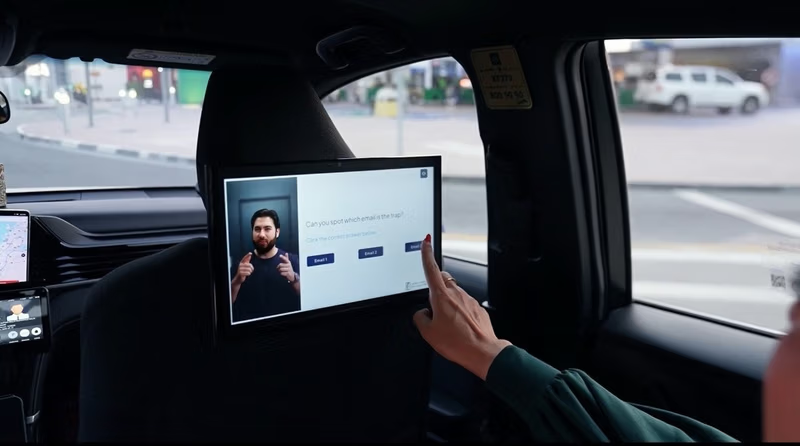

The “Spot the Fraudster” initiative, which ran from 24 July to 30 September 2025, pioneered Dubai’s first interactive in-cab fraud prevention experience, powered by Binary’s connected taxi screen network across the RTA’s fleet.

By using passengers’ idle transit time — when they are most receptive, the campaign presented a simple, interactive challenge to identify a fraudulent banker, turning a routine journey into an opportunity for proactive learning.

This initiative highlights the bank’s proactive stance in combating financial crime by empowering its customers with knowledge. Through its interactive quiz format, the campaign not only raised awareness but also fostered a deeper understanding of fraud prevention.

Over its duration, the initiative served 601,295 spots across Dubai’s taxi network and actively engaging 37,247 passengers. This high level of engagement resulted in an impressive Click-Through Rate (CTR) of 6.19%, exceeding typical industry averages and demonstrating the campaign’s effectiveness in capturing passenger attention.

The ‘Spot the Fraudster Taxi Initiative’ represents an innovative approach to fraud awareness by moving beyond traditional channels. By integrating fraud awareness into the daily commute, the campaign engaged a captive audience in a way that was both memorable and practical.

By turning transport networks into educational platforms, the bank has set a new standard for how financial institutions can conduct meaningful, large-scale public awareness campaigns.

Santosh Sarma, CEO, Binary, said: “We are extremely pleased with the outcome of the ‘Spot the Fraudster Taxi Initiative’. This campaign for Emirates NBD has established a new standard for interactive in-cab connected TV advertising, showcasing the effectiveness of our platform to deliver impactful, engaging messages. We did not simply broadcast a message; we invited participation. This turned a media impression into a substantive experience, which is reflected in the outstanding response rates.”