In the Gulf’s rapidly evolving construction landscape, real-time visibility and data accuracy are no longer operational upgrades; they’ve become strategic advantages. As developers in the UAE and Saudi Arabia take on larger, faster, and more complex projects, AI-driven insights are emerging as the differentiator that determines who delivers on time, who controls costs, and who earns investor confidence.

The construction boom across the Gulf is massive. The Middle East construction market reached US$386.09 billion in 2024 and is forecast to nearly double to approximately US$712.8 billion by 2033, at a compound annual growth rate of around 7%.

Within that, Saudi Arabia and the UAE remain the leading hubs, together accounting for the bulk of mega-projects, infrastructure, real estate, logistics, and smart-city developments. Under this scale of activity, with tight deadlines, aggressive delivery schedules, high material and labor costs, and demanding investor expectations, any inefficiency, rework, delay, or miscommunication can cripple profitability and market reputation.

That’s why developers are increasingly rejecting “paper-and-spreadsheet era” workflows and embracing real-time digital operations, data accuracy, and AI-driven workflows as strategic imperatives.

Speaking to Finance 360, PlanRadar CEO and Co-founder Ibrahim Imam broke down why digital oversight, field-verified data, and AI-powered workflows are now essential tools for any developer competing in the region’s high-stakes market.

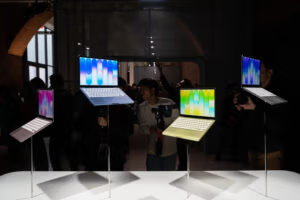

At this year’s Big 5 Global in Dubai, PlanRadar turned heads with its showcase of SiteView and new AI-powered workflows, tools that Imam says are redefining how construction teams operate across the Gulf.

Real-time data replaces reactive problem-solving

Imam says the biggest leap forward is simple but transformative: verified, real-time field data, replacing fragmented site communication.

“Traditional methods like manual notes, WhatsApp photos, or scattered spreadsheets create information gaps that contribute to nearly $1.8 trillion in global losses each year,” he explains. “With SiteView and AI-powered workflows, teams capture inspections, progress, and issues directly from the field, giving all stakeholders immediate visibility.”

The result?

Reporting times cut by up to 60%, fewer errors, and dramatically reduced rework. On several large UAE and Saudi projects, Imam notes this has led to “faster decision-making, clearer accountability, and far more predictable construction timelines.”

Smart districts driving digital twin adoption

Imam says the most rapid adoption of digital twin technology is happening inside the UAE’s newest smart districts and large-scale master developments, projects designed with long-term asset performance at their core.

Developments such as Expo City Dubai, Masdar City, and several mixed-use districts aligned with the Dubai 2040 Urban Master Plan are now building digital twins into their infrastructure from the earliest stages, using them to optimise energy consumption, streamline maintenance, and enhance operational efficiency.

Industrial and logistics hubs driven by the UAE’s “Operation 300bn” strategy are also accelerating adoption as developers seek smarter ways to manage equipment lifecycles and reduce downtime.

“While PlanRadar is not a digital twin engine, it plays a crucial role by providing the field-verified data, inspections, and AI-powered 360° visual mapping needed to keep digital twins accurate and operationally valuable,” he added.

Keeping fast-paced UAE projects audit-ready

In a market as fast-moving as Dubai’s real estate sector, the pressure to maintain compliance and investor-grade transparency is higher than ever. Imam explains that this is where real-time documentation has shifted from a workflow convenience to a strategic requirement.

“Dubai’s project environment moves quickly, but regulatory compliance has never been more demanding,” he says. “For developers, the ability to produce investor-grade progress reports, risk summaries, and QA/QC insights from a single source of truth strengthens transparency and accelerates decision-making. Several UAE developers have reduced handover documentation times by up to 50%, directly improving revenue recognition and investor confidence.”

Why AI-driven site visibility gives UAE developers an edge

As Saudi Arabia and the UAE compete to attract global capital to their mega-projects, accountability and transparency are now financial differentiators.

“Global capital prefers projects with measurable governance… AI-powered 360° site visibility allows stakeholders to monitor progress remotely, reducing travel, shortening approval cycles, and limiting delays. This level of transparency lowers project risk, which can result in more favourable financing terms.”

He highlights the ESG angle as well, saying that institutional investors entering the GCC now ask for ESG-ready reporting. Digital oversight makes that possible.

Protecting margins amid rising GCC costs

With material prices fluctuating and mega-project timelines tightening, cost control has become central to developer strategy. Imam says the worst culprit is one of construction’s oldest problems: rework, which globally accounts for 10–15% of project value.

PlanRadar enables developers to manage these costs. Teal-time communication prevents scope drift, while standardised inspections strengthen contractor accountability. And at the end of the cycle, faster digital handovers can cut weeks off delivery, accelerating cash flows across large housing or industrial portfolios.