Gold has extended its winning streak to a third straight week, lifted by expectations of U.S. interest rate cuts and renewed safe-haven demand, as investors brace for critical inflation data later this week.

The rally began in late August when downward revisions in payroll figures pointed to a softer labor market. That initially fueled hopes of an outsized 50-basis point cut in September, though those bets faded after stronger producer price index (PPI) data hinted at lingering inflation pressures. Still, softer August jobs data has revived speculation that a bigger move remains on the table.

According to Daniela Sabin Hathorn, Senior Market Analyst at Capital.com, the upcoming inflation prints will be pivotal. “Softer readings would reinforce the view that the Federal Reserve is going to cut aggressively over the coming months, which would benefit gold in both the short and long term. Hotter data, however, could inject nervousness into markets, raise fears of stagflation, and ramp up volatility,” she explained.

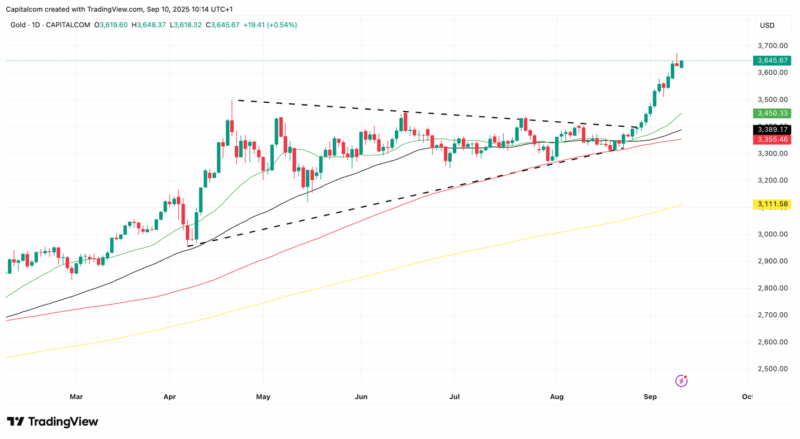

The shifting outlook has weakened the U.S. dollar, supporting dollar-denominated commodities. Gold has emerged as a clear outperformer, rising nearly 8% since breaking above a symmetrical triangle pattern at the end of August. Still, as a non-yielding asset, its appeal depends on continued price appreciation as a portfolio hedge.

Technically, the trend remains bullish. Hathorn noted that lower rates, a weaker dollar, and uncertainty around the Fed’s independence are all tailwinds for the precious metal. Longer-term, diversification away from the dollar as the dominant reserve asset could also underpin a more durable rally.