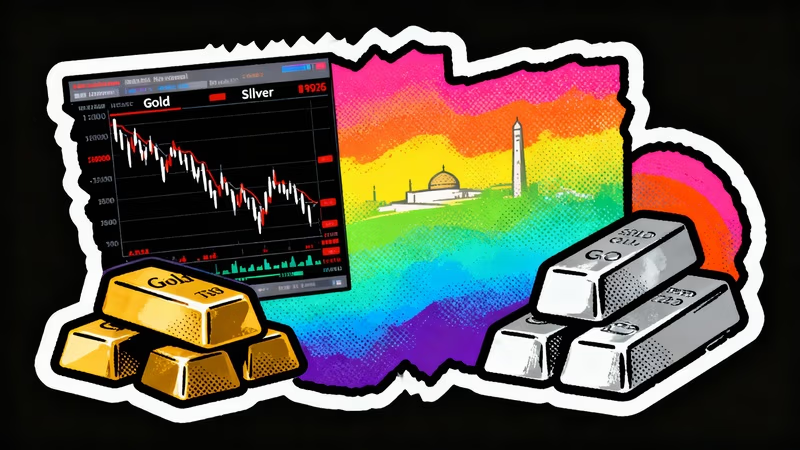

Gold and silver prices declined sharply on India’s Multi-Commodity Exchange as traders booked profits after recent gains, according to data reported by LiveMint. MCX gold futures fell by over 3 percent during intraday trade, while silver prices declined by more than 4 percent, reflecting a pullback from elevated levels amid strength in the U.S. dollar.

The correction followed a strong rally in precious metals in recent sessions, which had pushed prices to multi-session highs. The decline coincided with an increase in the U.S. dollar index, a factor that typically weighs on dollar-denominated commodities by raising costs for buyers using other currencies. LiveMint reported that bullion prices moved in line with global cues, including currency trends and broader macroeconomic signals.

Gold remains a closely watched asset across the UAE and the wider Middle East, where it serves as both an investment instrument and a physical commodity. Price movements on benchmark exchanges such as MCX influence sentiment among regional investors, bullion traders, and wealth managers who monitor global trends for portfolio allocation and risk management. Volatility in precious metals prices also affects gold-linked investment products offered by financial institutions across the Gulf.

Data cited by LiveMint showed that MCX gold futures declined by more than 3 percent during the session, while MCX silver futures recorded a sharper fall of over 4 percent. The pullback followed sustained buying in earlier sessions, increasing the likelihood of short-term corrections as traders moved to lock in gains. The strength of the U.S. dollar further pressured bullion prices during the session.

From a market perspective, the decline reflects near-term profit booking rather than a change in longer-term demand dynamics. Precious metals often experience corrective moves after sharp rallies, particularly in periods of heightened volatility and shifting currency trends. For investors in the UAE and the Middle East, such price movements typically prompt portfolio rebalancing rather than exits, especially among long-term holders who view gold as a store of value.

Currencies pegged to the U.S. dollar, including the UAE dirham, tend to experience relatively stable local pricing during periods of global bullion volatility. However, movements in international benchmarks continue to shape investor sentiment and trading activity across regional gold markets.

Going forward, gold and silver prices are expected to remain sensitive to global macroeconomic developments, currency movements, and policy signals from major economies. Market participants in the Middle East will continue to track international benchmarks alongside regional physical demand trends to assess near term market conditions.