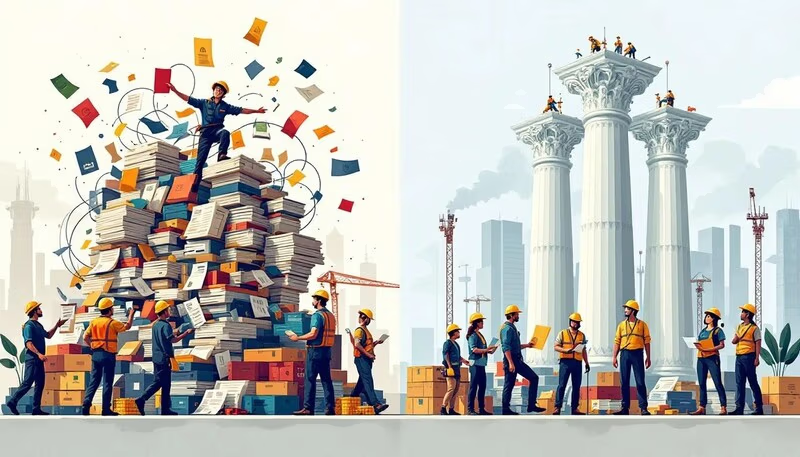

The Government of India has enforced four labour codes designed to streamline wage standards, workplace safety, industrial relations, and social security. The regulations consolidate 29 existing laws into one framework, aimed at simplifying compliance for employers while expanding protections for workers.

The Code on Wages (2019), Industrial Relations Code (2020), Code on Social Security (2020), and Occupational Safety, Health and Working Conditions (OSHWC) Code (2020) came into effect on 21 November. Many existing labour laws date back to the 1930s–1950s and do not reflect contemporary work models, including gig platforms and contract-based jobs.

Shramev Jayate!

— Narendra Modi (@narendramodi) November 21, 2025

Today, our Government has given effect to the Four Labour Codes. It is one of the most comprehensive and progressive labour-oriented reforms since Independence. It greatly empowers our workers. It also significantly simplifies compliance and promotes ‘Ease of…

Under the new framework, all workers, including gig and platform workers, will be eligible for statutory social security benefits such as the provident fund, insurance, and ESIC. Appointment letters will be mandatory, ensuring written proof of employment and formalisation. A universal minimum wage floor will apply across all sectors, replacing the earlier system where wage protection covered only certain scheduled industries.

The codes mandate timely payment of wages, gender-neutral hiring practices, and equal pay for equal work. Women may work on night shifts, and all occupations are subject to safety provisions. Free annual health check-ups are compulsory for workers aged 40 or older. Preventive healthcare, previously not required by law, becomes a mandatory employer responsibility.

Compliance processes will be simplified through single registration, single licence, and single return filings. Inspector-cum-facilitator roles will focus on compliance support rather than punitive measures. Industrial tribunals will be expanded to speed up dispute resolution.

Sector-wide Implications

- Fixed-Term Employees (FTEs): Will receive benefits equivalent to permanent workers and become eligible for gratuity after one year of continuous service, instead of five.

- Gig and Platform Workers: Aggregators must contribute 1–2 percent of their turnover, with benefits linked to an Aadhaar-based universal account number.

- Contract Workers: Employers must provide health and social security benefits, as well as mandatory health check-ups.

- Women Workers: Can work in all roles, including mining and hazardous industries, with required safety measures and grievance committee representation.

- MSMEs: Minimum wages, welfare facilities, and working-hour limits will apply across micro, small, and medium enterprises, supported by simplified compliance.

- Plantation, Mining, Textile, Dock, Export, and Hazardous Industry Workers: All will receive expanded safety standards, portability of benefits, mandatory medical facilities, and overtime protections.

The OSHWC code introduces national safety standards, mandatory safety committees in establishments with more than 500 employees, and protective equipment requirements in high-risk sectors.

Broader Impact

Indian Government data shows that social security coverage has increased from 19 percent of the workforce in 2015 to more than 64 percent in 2025. The implementation of the four codes builds on this expansion by making benefits portable across states and employment types.

The government plans further stakeholder consultations while drafting detailed rules under the codes. Existing regulations will remain valid during the transition period.