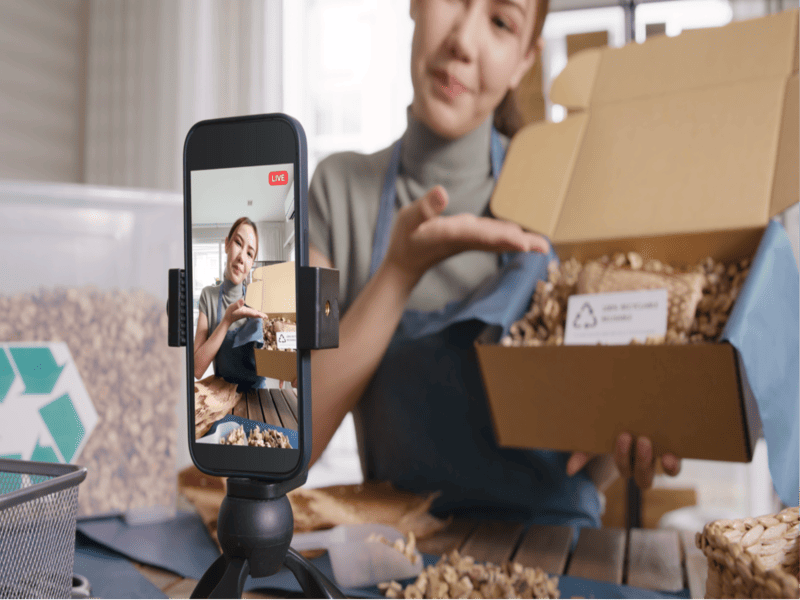

Social media influencers have been ranked as the UAE’s most distrusted profession for the first time, overtaking credit card issuers and recruiters, according to Insight Discovery’s seventh annual Worst Reputation in the UAE survey.

Influencers Top the List

The study found that 21% of UAE residents believe influencers hold the worst reputation, citing concerns over misleading promotions, lack of transparency, and undisclosed endorsements. The issue has been particularly pronounced with “finfluencers,” many of whom have promoted unregulated investment schemes and exaggerated financial advice.

Telemarketers and call centres followed closely at 19%, while credit card issuers (13%) and recruitment companies (11%) also remained high on the list. Real estate brokers came in at 8%, continuing to face criticism for hidden fees and aggressive selling.

Shifting Public Perceptions

The survey signals a sharp shift in sentiment: for most of the past six years, recruiters and credit card issuers topped the list, but the rise of influencers highlights growing public concern around accountability in the digital economy.

Nigel Sillitoe, CEO of Insight Discovery, said:

“The rise of influencers to the top of this list is a clear wake-up call for the industry. As audiences grow more conscious of the risks linked to unregulated online advice, the demand for transparency and accountability has never been stronger.”

He added that the UAE’s recent licensing regime for finfluencers, introduced by the Securities and Commodities Authority (SCA), is a crucial step toward restoring public confidence.

Demographic Breakdown

- Westerners, Arab expats, and Emiratis largely agreed that influencers have the worst reputation.

- Asians (23%) were most critical of telemarketers.

- In Dubai, 10% of residents viewed real estate agents unfavourably, particularly professionals aged 25–44.

- Bank financial advisers still face scepticism, ranking poorly among Emiratis (9%) and Abu Dhabi residents (8%).

- Independent advisers fared little better, with distrust especially strong among Westerners (11%) and high-income groups (9%).

Professions Improving Their Standing

Financial advisers showed the most improvement in reputation compared to last year:

- Bank advisers experienced a significant drop in negative perception, from 12% to 5%.

- Independent advisers declined from 7% to 5%.

The findings suggest that regulatory scrutiny and stronger compliance frameworks in the financial services sector are beginning to pay off.

The Bigger Picture: The survey underscores how reputations across industries are increasingly tied to transparency, regulation, and consumer trust. While traditional frustrations such as telemarketing remain, the focus has shifted towards digital influence and the power of online personalities—making reputation management more critical than ever.