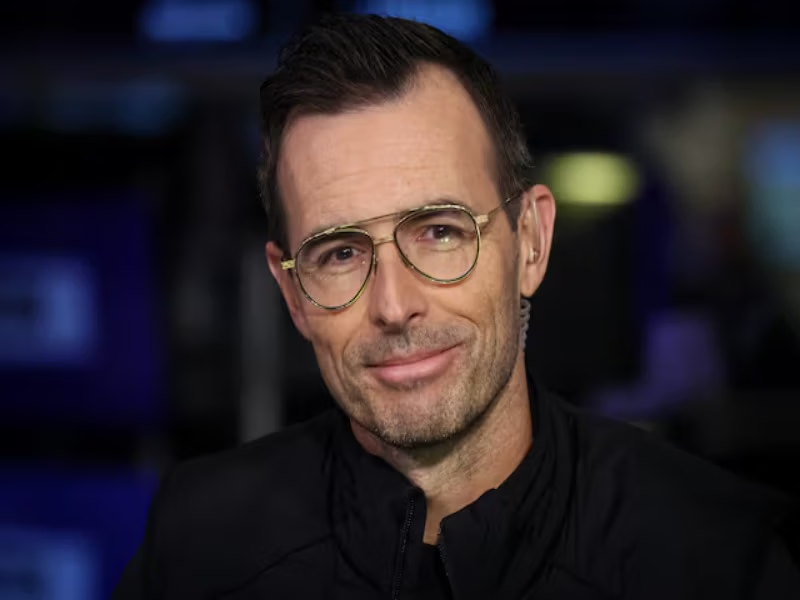

Lululemon declared on Thursday that its CEO, Calvin McDonald, would resign, and it will be effective on January 31, after more than a year of underperformance at the athleisure company.

In a news release, the company said that its board of directors is working with a “leading executive search firm” to identify its next CEO. McDonald will continue as a senior advisor as of March 31.

McDonald stated on a call with analysts that “The timing is right for a change. I’ve described being CEO of Lululemon as my dream job. It truly has lived up to every expectation and given me the opportunity of a lifetime.”

Lululemon’s CFO, Meghan Frank, and Chief Commercial Officer, André Maestrini, will operate as interim co-CEOs during the search process. The company’s board chair, Marti Morfitt, will also hold the expanded role of executive chair.

In a statement, she stated that the company is well established and has a lot of foundation, but requires a new leader who would take it through a transition.

Morfitt said that “As we look to the future, the Board is focused on identifying a leader with a track record of driving companies through periods of growth and transformation to guide the company’s next chapter of success.”

However, the shares surged approximately 10 percent in extended trade. The change in the leadership comes after a year of weak performance by Lululemon and requires the leadership to change by its founder and its largest independent shareholder, Chip Wilson.

Two months back, he placed a full-page advertisement in the Wall Street Journal where he stated that the company was “in a nosedive” and it needed to “stop chasing Wall Street at the expense of customers.”

Lululemon also announced the exit of McDonald the same day it reported fiscal third-quarter earnings and a second set of weak guidance.

The company has performed as follows, as compared to the expectations of Wall Street, according to a survey of analysts by LSEG: Earnings per share: $2.59 compared to $2.25 expected. Revenue: $2.57 billion compared to $2.48 billion expected.

The net income reported by the company during the three months that ended November 2 was $306.84 million or $2.59 per share, compared with that of a year earlier, which was $351.87 million or $2.87 per share.

Sales increased by $2.57 billion, a surge from $2.40 billion a year earlier. In the current quarter, Lululemon, McDonald’s informed that the company is “encouraged” about its performance in the holiday season, and its guidance was lower than Wall Street expectations.

LSEG data reported that it predicts sales ranging between $3.50 $3.59 billion, with the larger percentage being less than expected of $3.60 billion. It projects earnings of between $4.66 $4.76, which is far lower than what is projected to be at $5.03.

During the last two quarters, Lululemon reduced its annual projections. More than a month into the final quarter of the year, it surged its full-year expectations on Thursday.

According to LSEG, it estimates sales will be between $10.96 billion and $11.05 billion, in line with expectations at the low end. It anticipates that the earnings per share will range between $12.92 and $13.02, which is close to the figures of $13.

McDonald’s reported that on its Thanksgiving weekend, the company was experiencing a high demand, and this enabled it to clear its stale inventory at a discount.

McDonald added that “I also want to acknowledge we’ve seen trends slow a bit since Thanksgiving, which we’ve taken into account in our Q4 guidance. However, despite this, we expect revenue trends in the U.S. and Q4 to be modestly improved relative to Q3.”

The pressures on Lululemon’s business over the past year have been due to its navigation of the effects of tariffs, a shaky U.S. consumer, and a product assortment no longer astonish shoppers like it did in the past.

It is also experiencing high competition in the athleisure segment by new brands such as Vuori and Alo Yoga, and changing consumer preferences. Rather than yoga pants, denim is becoming the clothing that many shoppers are grabbing these days.

In order to fuel growth and reach more people, Lululemon has been striving to take its business global and provide more variety to its shoppers.

Lululemon has gone beyond mere workout apparel to shoes, outerwear, such as coats and jackets, and casual pants that can be worn to the workplace as well.

The overall business of the company is expanding, which has mainly been because of the international business and the opening of new stores; its biggest market, the Americas, is experiencing a downturn.

In the quarter, revenue dropped by 2 percent in the Americas, and similar sales slipped by 5 percent; international sales increased by 33 percent. Similar sales in the foreign market grew 18 percent.

Lululemon itself is being affected by the end of the de minimis exemption, permitting low-value packages to enter the U.S. duty-free, somewhat more badly than its counterparts.

It stated in September that estimated tariffs would cost it its entire annual profits by $240 million, and the majority of its expenses would be due to the loss of the de minimis exemption.

After progress with vendor negotiations and other mitigation efforts, it currently expects tariffs to reduce its profits by $210 million.