The proposed Netflix Warner deal, valued at USD 72 billion, stands to fundamentally reshape the global entertainment industry by giving Netflix control of some of Hollywood’s most valuable intellectual property and studios. The agreement, reached after Warner Discovery elected to separate its studio and HBO Max assets from its cable operations, would represent one of the most consequential consolidation events in decades.

Netflix’s offer outpaced competing bids from Paramount and Comcast, ending weeks of speculation about Warner’s future. The speed with which the deal was assembled surprised many industry observers, who had viewed Paramount as the likely buyer earlier in the process. After Paramount made unsolicited approaches to acquire Warner Discovery, the company accelerated its sale plans, opening the way for Netflix’s bid.

John Malone, former Warner Discovery board member and current adviser, said Netflix was “aggressive about pursuing the value.”

A Transformational Content Library for Netflix

If approved, the acquisition would give Netflix control of one of the deepest and most commercially successful content portfolios in Hollywood across film, television, gaming, animation, and prestige franchises.

Primary IP and franchises Netflix would acquire include:

Core Film & Television Properties:

Harry Potter, Friends, The Lord of the Rings film rights, Game of Thrones, The Sopranos, The Matrix, Mad Max, Casablanca, Citizen Kane, The Wizard of Oz, Dune 3 (distribution rights only), Ocean’s, The Hangover, The Conjuring, Final Destination, The Goonies, Beetlejuice, Evil Dead, Gremlins.

Animation and Youth Brands:

Looney Tunes, Tom & Jerry, Scooby-Doo, Adventure Time, The Powerpuff Girls, Courage the Cowardly Dog, The Flintstones, The Jetsons, Johnny Bravo, Robot Chicken, Rick & Morty, Adult Swim, Cartoon Network, Smiling Friends, The Boondocks.

Premium Networks and Streaming Assets:

HBO, HBO Max, TCM (Turner Classic Movies).

Gaming and Interactive Entertainment:

WB Games, including NetherRealm (Mortal Kombat), Rocksteady, and TT Games, as well as rights associated with LEGO games and planned projects tied to film IP, such as Minecraft.

Control of these franchises would significantly strengthen Netflix’s long-term competitive moat at a time when streaming growth is plateauing, and legacy studios are facing financial strain. Industry analysts note that this would give Netflix unprecedented influence across cinema, streaming, animation, and gaming in a single consolidation move.

A New Phase in Hollywood Consolidation

Netflix’s evolution from a DVD-by-mail start-up founded by Reed Hastings and Marc Randolph to the potential owner of Warner Bros. illustrates the scale of disruption reshaping the entertainment industry. Over nearly three decades, Netflix has forced structural changes in how content is produced, distributed, and monetised. The purchase of Warner Bros. would further shift the balance of power away from traditional studios toward tech-driven platforms.

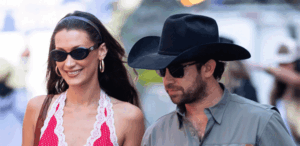

The negotiations unfolded against a backdrop of close personal relationships among senior executives. Warner Discovery Chief Executive David Zaslav and Netflix co-CEO Ted Sarandos have maintained long-standing ties and were seen together at the Canelo Alvarez–Terence Crawford fight in Las Vegas at the height of negotiations.

Regulatory Review Ahead

The deal will undergo regulatory scrutiny given its size and the consolidation of premium content libraries under a single global streaming platform. Analysts expect attention to competition in licensing and distribution, and to the implications for smaller studios that rely on Warner-owned IP.

If completed, the transaction would cement Netflix as the largest integrated entertainment entity of the streaming era, combining enormous content inventory with global distribution scale.