Five market sources reported that the Abu Dhabi National Oil Co (ADNOC), the global trading arm, is leasing fuel oil storage in Singapore for the first time, as part of the United Arab Emirates-supported oil and gas producer’s plans to boost trade volumes in Asia.

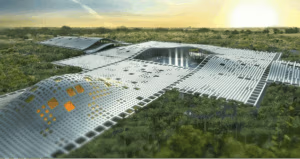

Two familiar sources stated that the ADNOC Global Trading, or AGT, has signed a lease for about 160,000 cubic metres of fuel oil storage capacity at the Jurong Port Universal Terminal, the largest onshore terminal for storage of the residue fuel in the city state.

The action broadens the presence of the state giant in Singapore, the largest bunkering center in the world, where traders store and mix the fuel to fill ships and to re-export to meet the demands of the region.

The current presence of ADNOC in Singapore is through an office that deals with crude marketing, research, and trading. The lease of AGT commences in February, but its term is not known immediately. They declined to be identified as the matter is commercially sensitive.

Therefore, ADNOC declined to comment. Jurong Port Universal did not immediately respond to a request for comment. The trading business of ADNOC includes two segments: ADNOC Trading, which deals with crude oil, and ADNOC Global Trading, in partnership with Italy’s Eni and Austria’s OMV, where the business deals with refined products.

The industry perceives onshore oil storage as a strategic asset to companies and their trading activities. It enables traders to opportunistically purchase and sell when prices are favorable by occupying storage capacity.

This step by ADNOC expands the trading house presence in a very competitive Singapore fuel oil market among the largest trading houses, Vitol, Trafigura, and PetroChina.

AGT generally purchases high-sulphur fuel oil cargo skewed in the Middle East and sells it to the trading houses and refineries in Asia delivered fashion. They reported that it is also an active fuel supplier to Fujairah, the world’s fourth-largest bunkering port.

The demand for fuel oil storage in Singapore has also been very strong, and onshore inventories of residual fuel increased last year. Enterprise Singapore indicated that the weekly inventories stood at an average of 22.8 million barrels in 2025, compared to 19.7 million barrels in 2024.