In a development that continues to keep global markets on edge, the U.S. Supreme Court did not issue a decision Friday on the legality of President Donald Trump’s broad tariff program, prolonging legal uncertainty over a case that has major implications for trade policy, executive authority, and fiscal revenues.

Investors, importers, and trade lawyers had been bracing for a ruling on Friday, as speculation mounted that the Court would take up the controversial issue of presidential tariff powers used under the International Emergency Economic Powers Act (IEEPA). But when the Court released only one unrelated opinion, traders were left waiting. The next slate of rulings is expected on Wednesday, January 14.

What’s at Stake: Authority, Tariffs, and Trade Policy

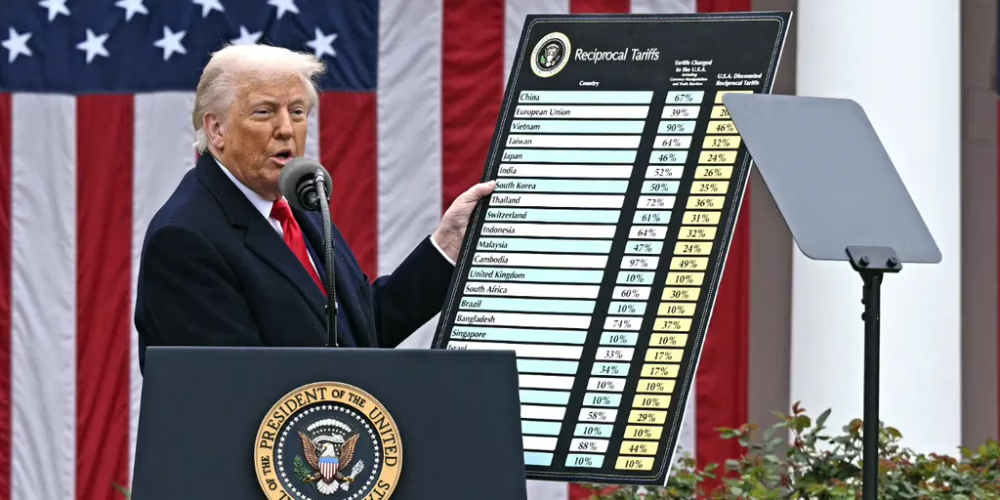

When the Supreme Court does weigh in, it will focus on two central questions: whether the Trump administration had the authority to impose sweeping tariffs under IEEPA, and if not, whether the government will have to reimburse importers who paid those duties.

IEEPA, a law enacted in 1977 to grant presidents special powers during a national emergency, has never before been used to justify tariffs, and critics argue that the statute does not expressly allow such measures, a point that lower courts have already highlighted in rulings that struck down aspects of Trump’s tariff program.

The Lower Court Landscape: Legal Challenges and Appeals

Several lower courts have weighed in on the legality of the tariff program. In V.O.S. Selections, Inc. v. Trump, a U.S. Court of International Trade panel ruled in May 2025 that Trump overstepped his authority under IEEPA by imposing tariffs aimed at long-standing trade deficits, not clearly tied to a genuine emergency condition. That decision was stayed pending appeal, allowing the tariffs to remain in effect as the legal battle moves upward.

Across multiple lawsuits, federal judges have questioned whether an emergency law intended to regulate commerce could validly authorize tariffs without explicit congressional backing, under what legal scholars call the major questions doctrine. That doctrine holds that decisions of vast economic or political significance require clear congressional authorization, a principle courts have invoked in similar disputes.

What Happens Next: Potential Outcomes and Market Impacts

The Supreme Court’s ultimate ruling could fall anywhere on a spectrum of possibilities. In the event the tariffs are upheld, they could continue to serve as a significant revenue source for the Treasury and a tool of U.S. trade policy. If struck down, the court could limit presidential authority under IEEPA and require refunds to importers, potentially exceeding $150 billion, according to companies challenging the duties.

U.S. Treasury Secretary Scott Bessent has played down the refund risk, telling reporters the Treasury has ample funds to handle potential repayments over time, even as he acknowledged that a ruling against the administration’s authority would reduce executive flexibility on trade tools.

Market expectations reflect this uncertainty. Prediction markets show only modest odds, roughly 28–30%, that the tariffs will be upheld, and equities in some affected sectors have shown early reactions to the pending decision. Retailers and consumer-focused stocks are seen as potential beneficiaries of tariff rollback, as lower input costs could improve profit margins if import duties are removed.

Broader Policy Implications

Beyond the immediate market effects, the case raises deep questions about the separation of powers and the role of the executive branch in shaping economic policy. A ruling against Trump’s use of IEEPA could narrow presidential authority, forcing future administrations to rely more heavily on existing trade statutes, such as Sections of the 1962 Trade Act or Section 301 unfair trade laws.

Economists and legal analysts also note that even if some tariffs are struck down, the overall tariff regime may remain complex and uncertain, with many duties imposed under other statutes remaining in place. The Court’s decision could thus reset, rather than upend, U.S. trade policy, especially as businesses and governments adapt to evolving legal standards.

What This Means for Readers and Markets

For finance news readers, the lingering tariff ruling serves as a reminder that legal and policy uncertainty can ripple through markets just as powerfully as economic data or central bank moves. Trade policy — often viewed as arcane — sits at the heart of global supply chains, pricing for consumer goods, and corporate earnings, and this case is a rare moment when it intersects with constitutional law, fiscal strategy, and international commerce.

As markets await the Supreme Court’s next move, traders and investors should watch for shifts in tariff-related sectors and companies that stand to benefit from lower import costs, a dynamic that could influence market rotations if the decision ultimately favors importers.

With the Supreme Court delaying its decision, uncertainty remains the dominant theme. But when the ruling finally comes, it could reshape not just U.S. trade policy, but how the executive branch is allowed to wield economic power, with consequences for markets, tariffs, and global commerce.