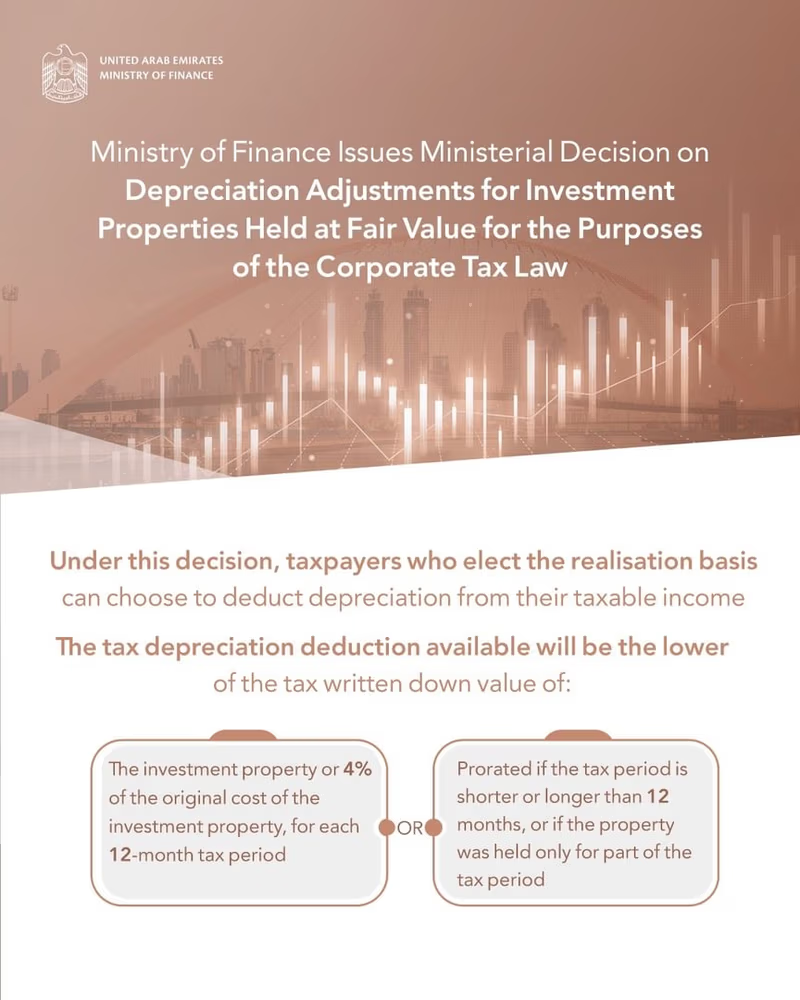

The UAE Ministry of Finance has announced a key update to its corporate tax framework with the issuance of a Ministerial Decision on Depreciation Adjustments for Investment Properties held at Fair Value under Federal Decree-Law No. (47) of 2022 on the Taxation of Corporations and Businesses.

The decision allows taxpayers who adopt the realisation basis to claim tax depreciation for investment properties valued at fair value, thereby aligning the treatment with those holding assets on a historical cost basis.

Key Highlights:

- Taxpayers may deduct the lower of the tax written-down value or 4% of the original cost of the investment property per 12-month tax period.

- This tax depreciation for investment properties is available to assets held before or after the introduction of the UAE corporate tax regime.

- The deduction is irrevocable and must be elected in the first tax period that begins on or after January 1, 2025.

- The decision provides clarity on asset valuation for tax purposes in cases of:

- Transfers between related or unrelated parties

- Assets developed internally by the taxpayer

The Ministry has also introduced a one-time window for taxpayers to opt into the realisation basis for the purpose of claiming this deduction, even if the initial election deadline has passed. This aims to provide transitional flexibility as the new regime takes effect.

“The decision provides parity between taxpayers holding investment properties on a historical cost basis and those using fair value, ensuring tax neutrality across the board,” the Ministry said in a statement.

Guidance on Claw-Back Scenarios

To maintain transparency and compliance, the new directive also specifies circumstances where claw-back of depreciation deductions may occur outside of typical disposals. This provision helps businesses prepare for potential tax liabilities and aligns the treatment with international standards.

The move underscores the UAE’s commitment to fostering tax equity and global best practices, particularly as the nation’s corporate tax landscape evolves in its second year of implementation.

–Input WAM