With a rough job market and rising uncertainty about the role of artificial intelligence in hiring, many Americans are considering grad school to improve their chances, but that strategy might not help if you’re aiming for a seat at the nation’s economic helm.

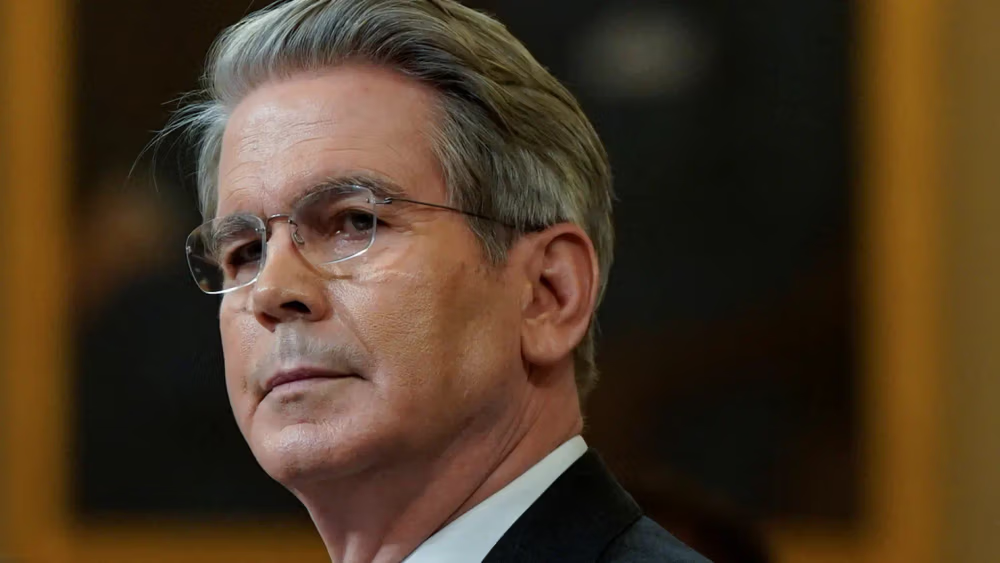

U.S. Treasury Secretary Scott Bessent on Monday offered a scathing critique of the Federal Reserve, questioning both its academic-heavy approach and its decision not to cut interest rates this year, despite cooling inflation indicators.

“All these Ph.D.s over there — I don’t know what they do,” Bessent said in a CNBC interview, implying that the Fed’s monetary policy team may be stuck in outdated thinking.

While June’s consumer price index (CPI) showed the highest inflation since February, overall trends suggest inflation has significantly slowed. That’s what has left Bessent and others in the Trump administration puzzled by the Fed’s cautious stance.

Markets Soar Despite Policy Friction

Despite tensions between the White House and the Fed — and looming trade negotiations — the stock market continues to rally. On Monday, the S&P 500 closed above the 6,300 mark for the first time, led by gains in tech giants Meta and Amazon. The Nasdaq Composite also hit a new all-time high. Across the Atlantic, however, Europe’s Stoxx 600 dipped slightly by 0.08%.

Bessent hinted that August 1’s upcoming tariff deadline could be used as leverage in trade talks, saying it “will help the U.S. reach better agreements” with partners.

His remarks added fresh uncertainty to an otherwise euphoric equity market, reinforcing the idea that you don’t need a Ph.D. to know volatility may still be around the corner.

Crypto And Chips: The New Frontiers

In a surprise development, Trump Media now holds roughly $2 billion in bitcoin, making up two-thirds of its liquid assets. The crypto-heavy portfolio signals President Trump’s growing embrace of digital currency as a strategic asset.

Meanwhile, Nvidia’s decision to resume chip shipments to China — reportedly with Washington’s blessing — has sparked a geopolitical debate. Analysts are divided on whether the move undercuts U.S. dominance in artificial intelligence or simply reflects the realities of global trade.