The United States has officially imposed a 50% tariff on Indian exports, a move that marks one of the most significant trade ruptures in U.S.–India relations in decades. The measure, introduced under President Donald Trump, doubles down on an earlier 25% levy, effectively imposing an additional 25% duty on Indian goods.

Billions in Trade at Stake

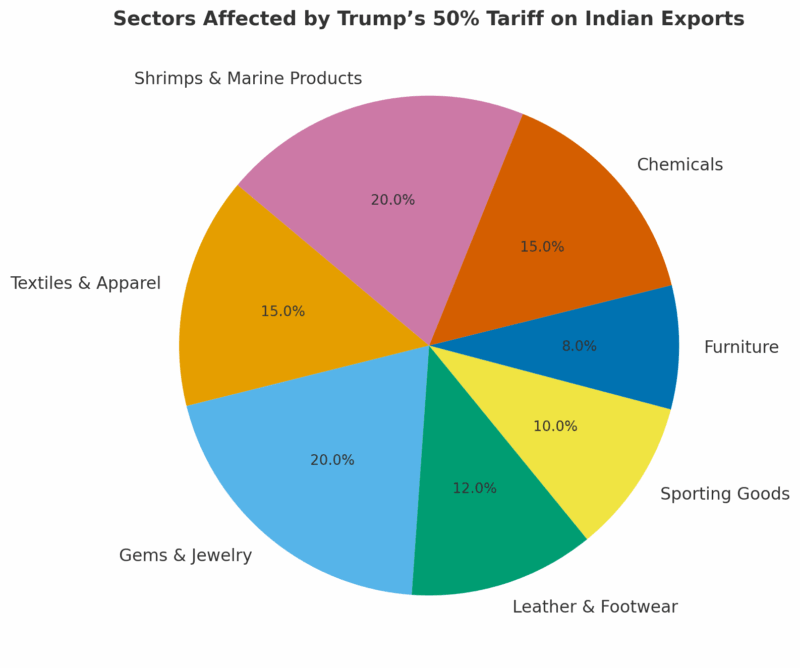

The tariff covers an estimated $48–$87 billion worth of Indian exports, accounting for nearly two-thirds of India’s total shipments to the U.S.. This includes sectors that have traditionally formed the backbone of India’s labor-intensive export economy:

- Textiles and apparel

- Gems and jewelry

- Leather and footwear

- Sporting goods, furniture, and chemicals

- Shrimps and other marine products

Notably, critical categories such as pharmaceuticals, IT services, and electronics (including mobile phones and tablets) have been spared from the levy, reflecting Washington’s selective targeting of industries.

India’s Response: Shielding the Economy

The Government of India has moved quickly to design a multi-pronged strategy aimed at limiting the damage:

- Diversifying export markets to reduce dependence on the U.S.

- Offering financial support and relief packages for vulnerable sectors

- Engaging in diplomatic outreach to seek flexibility or carve-outs

- Exploring trade expansion with Europe, the Middle East, and ASEAN partners

Indian officials have emphasized that while exporters will face short-term challenges, the country’s broader growth story, driven by domestic demand, manufacturing expansion, and increasing FDI inflows, remains intact.

Strategic Implications

Beyond trade, the tariffs could have deeper geopolitical consequences. Analysts warn that the decision risks undermining the U.S.–India strategic partnership, potentially pushing New Delhi to strengthen ties with China and Russia.

The timing is also critical. India has been positioning itself as a global manufacturing hub, part of its “Make in India” and “China+1” strategies. The tariffs now threaten to disrupt supply chains, dampen investor sentiment, and slow momentum in sectors already battling margin pressures.

Market & Investor Outlook

Market watchers remain divided:

- Some expect a hit to earnings in export-heavy industries, such as gems, textiles, and small-scale manufacturing.

- Others argue the broader impact may be overstated, pointing to India’s strong domestic consumption, resilient IT sector, and growing financial services market, particularly NBFCs and consumer-facing industries, which remain insulated from tariff shocks.

What’s Next?

For Indian exporters, the path ahead will be challenging. With compliance costs set to rise and competitiveness under threat, businesses may need to pivot quickly toward new markets and value-added products.

For policymakers, the move highlights the importance of de-risking trade dependencies while accelerating domestic reforms to attract investment and support local industries.

As the tariff battle unfolds, one thing is clear: this development is not just about trade, it is about the future balance of U.S.–India relations in a shifting global order.