The UAE’s real estate investment trusts (REITs) are witnessing a sharp rally in 2025, buoyed by surging demand for commercial property in both Dubai and Abu Dhabi. Rising sales, record rents, and near-full occupancy in prime districts have driven investors toward income-generating assets, boosting REIT valuations across the board.

Dubai’s Office Market Surges

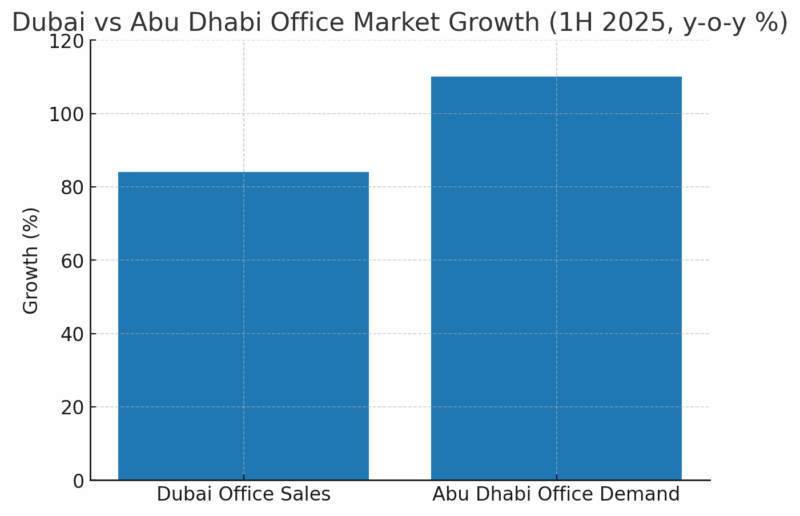

Dubai recorded nearly 2,000 commercial sales transactions in the first half of 2025, an 84% year-on-year increase to AED 5.4 billion, according to a Cavendish Maxwell report. Prices rose by 22.2% y-o-y to AED 1,700 per sq ft, while rents climbed 26.4% y-o-y, with prime hubs like DIFC and Downtown Dubai witnessing jumps of almost 35%.

Ready office units accounted for nearly 85% of transactions, but off-plan sales saw a significant surge, with values up 617.4% and volumes rising nearly 180% y-o-y, reflecting growing appetite for luxury-grade office space.

Business Bay led sales with 672 transactions, followed by Jumeirah Lakes Towers (534) and Motor City (216). Around 4,000 sqm of new commercial space was delivered in 1H 2025, with an additional 110,000 sqm expected by year-end and 340,000 sqm in 2026.

Abu Dhabi’s Strong Momentum

Abu Dhabi’s office and residential sectors are also seeing strong growth. Off-plan weighted average prices on Al Reem Island jumped 38% y-o-y in Q2 2025, with waterfront projects averaging AED 1,800 per sq ft, the fastest pace in the capital. Rental indices also show apartment rents on the island up 21% y-o-y, spurred by ADGM’s expansion.

Office demand surged, with more than 50,000 sqm absorbed in 1H 2025, a 110% y-o-y increase, pushing Grade A occupancy close to full.

REITs See Strong Gains

The rally has been reflected in listed REIT performance:

- Emirates NBD REIT (70% office portfolio) is up 54.2% YTD.

- Al Mal Capital REIT (AMCREIT) is up 48.7% YTD, following a follow-on public offering that raised AED 210 mn at AED 1.125 per unit. AMCREIT reported net income of AED 1.9 bn in 1H 2025, more than triple last year, with revenues up nearly 10%.

- Dubai Residential REIT also tripled net income on fair value gains.

- Emirates REIT, the UAE’s first listed REIT, is the only outlier, trading down 5.6% YTD at USD 0.50 despite posting a 6x y-o-y jump in 1Q 2025 net income to USD 149.7 mn.

Why Investors Are Attracted

REITs remain highly attractive in the UAE due to favorable regulations: they must distribute at least 80% of annual net profits to unitholders, offering stable income. They also enjoy tax advantages, with exemptions on corporate tax for REITs and no tax on distributions for UAE-based investors.

Outlook: Momentum To Continue

With Knight Frank projecting demand to outpace supply in 2025 and high-value transactions concentrated in prime districts, analysts expect UAE REITs to sustain momentum. Tight supply, rising investor appetite, and robust income distribution policies are reinforcing REITs’ position as one of the most attractive asset classes in the region.